Inside Horizon Robotics’ Shanghai Launch and the Road Ahead

At Horizon Robotics' latest product launch in Shanghai last night, I joined a bustling crowd of engineers, automakers, and media. The event – dubbed “Journey Ahead, Beyond Imagination– lived up to its name. Horizon unveiled its new Horizon SuperDrive (HSD), a full-stack "all-scenario" intelligent driving solution for L2-level urban driving assistance. This marked a significant advance beyond typical highway-only driver assistance systems. The HSD system runs on Horizon's newly launched Journey 6 automotive AI chips – the Journey 6P and 6H – delivering up to 560 TOPS of computing performance. These chips introduce a modular "Horizon Cell" design that enables plug-and-play hardware upgrades. This means automakers can upgrade the computing unit throughout a vehicle's life cycle by simply swapping in new Horizon chips ("like a magazine clip," as one engineer quipped) without redesigning the entire system.

From a technology standpoint, Horizon SuperDrive combines software and hardware in one package. It uses an end-to-end AI architecture running on the new Journey 6P chip – touted as the strongest domestic autonomous driving compute platform to date – making HSD China’s first fully integrated L2 urban driving system developed in-house by a local company . In live demos, HSD handled some of the most challenging city-driving scenarios:

Continuous urban lane changes: smoothly weaving through traffic while predicting gaps;

Yielding to pedestrians: proactively slowing when people cross unexpectedly;

“Ghost pedestrian” detection: spotting pedestrians darting out from blind spots (the Chinese call this “鬼探头”, a common city hazard) ;

Narrow street negotiations: politely pausing to let oncoming vehicles pass when road space is tight .

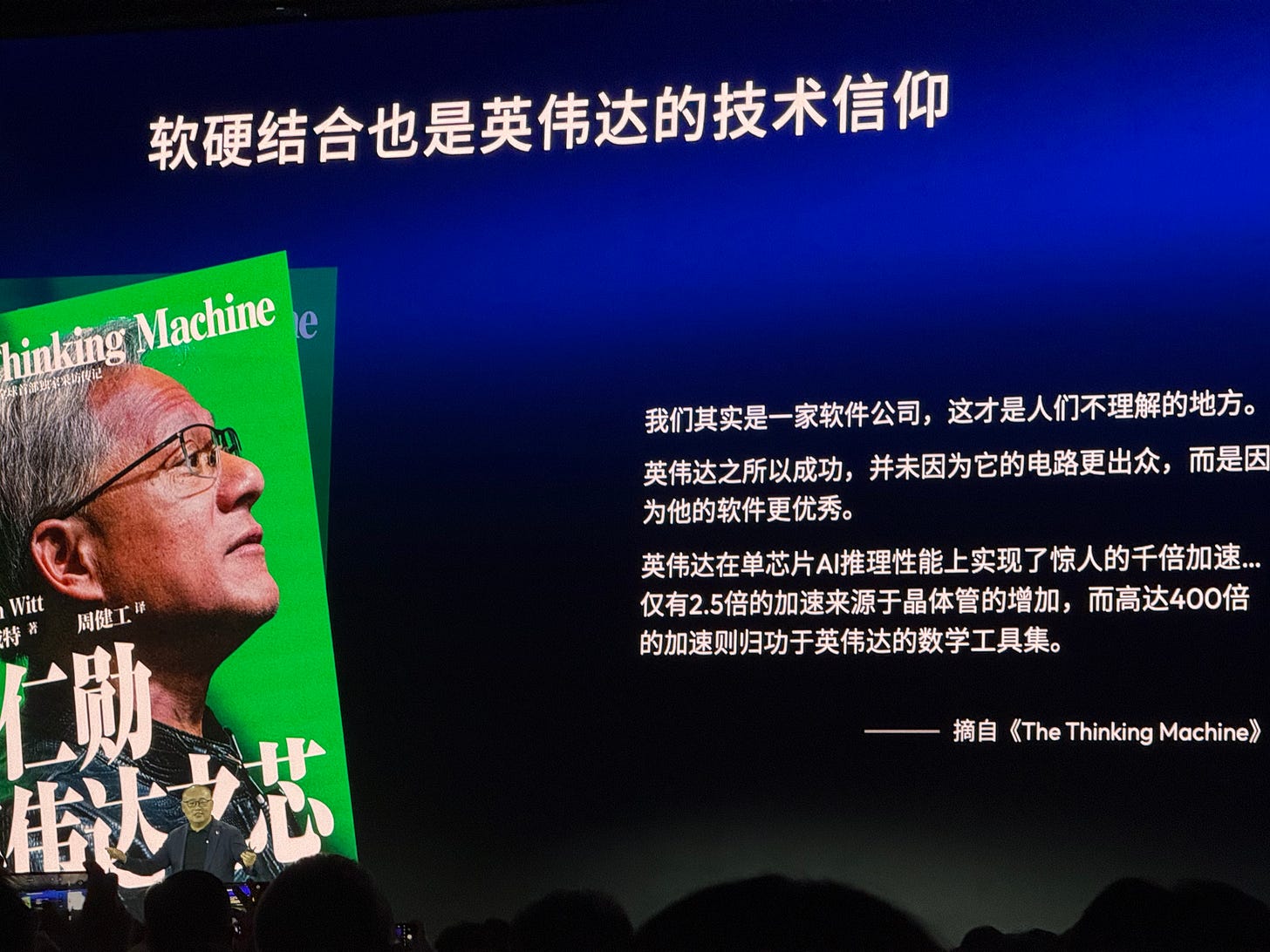

These maneuvers – which I witnessed during a test ride through downtown Shanghai’s hectic streets – showcased a human-like driving intuition that Horizon has been honing. According to Horizon, HSD’s AI is trained to prioritize safety, smoothness, and efficiency, aiming for a driving style that users can trust as if a skilled human driver were at the wheel . “Soft–hardware integration is in our bones,” Horizon’s founder and CEO Yu Kai reminded the audience, emphasizing that each generation of their in-car computing platform tightly couples custom silicon with advanced algorithms to maximize efficiency . In his view, until fully autonomous Level 5 driving becomes reality, the only path to improving intelligent vehicles is this deep fusion of software and hardware .

Another highlight was Horizon’s introduction of the “Horizon Cell” platform – a car-computer chassis that supports hot-swappable AI modules. This allows automakers to offer upgradeable ADAS: for instance, a consumer might buy a car with an entry-level HSD 300 package and later upgrade to HSD 600 or 1200 by plugging in more powerful compute units, without changing the car’s wiring or sensors . It’s a novel approach to future-proofing vehicles, and one that drew audible interest from the automaker representatives in the room.

These deals are significant because they position Horizon's technology in both Chinese domestic brands and global automotive platforms. Horizon SuperDrive is being marketed as a turn-key solution for automakers: an L2++ driving system that adapts quickly to different models and scenarios. By offering versions from mainstream to high-end, Horizon aims to democratize advanced driver-assistance, bringing features like smart city cruising and self-parking to mid-priced family cars, not just luxury vehicles. This aligns with China's industry trend toward "democratization of intelligent driving" – making advanced driving technology a standard feature, even in cars costing 100,000 RMB (~$15k).

As Yu Kai eloquently put it, Horizon wants to “let everyone hand over driving to Horizon, and give life back to themselves” . Standing at the Shanghai event, watching a test car navigate snarled traffic on its own, that vision didn’t feel so far-fetched. And with millions of Chinese commuters eager to embrace autonomous features, the HSD launchpositions Horizon as a key enabler of the next phase of car intelligence.

Interestingly, Yu Kai specifically mentioned Apple and NVIDIA, particularly noting that "the integration of software and hardware is NVIDIA's technological faith" - perhaps hinting at Horizon Robotics' own technological ambitions.

From Startup to IPO: The Rise of Horizon Robotics

While many people may not be familiar with Horizon Robotics, it has emerged as a rising star in the chip industry. Founded in 2015 by Dr. Yu Kai, Horizon began with a bold vision: intelligent machines would dominate the next era of computing, and these machines would need their own dedicated "brains." Yu Kai, a renowned deep learning expert, left his position as Baidu's deep learning institute director in mid-2015 to pursue this vision independently. His departure stemmed from a fundamental disagreement with Baidu's strategy—while the company's leadership viewed custom hardware development as "too heavy" a burden, Yu Kai believed that AI algorithms and semiconductor chips must be designed together to achieve true breakthroughs. This conviction—that software alone wasn't enough, and that AI needed bespoke chips—was revolutionary at the time. By 2012, Yu had already predicted that shifts in computing paradigms would "reconstruct the entire processor architecture" and that hardware's role would greatly expand. Acting on this insight, he became arguably the first person in China's tech community to suggest that an internet software company (like Baidu) should build its own AI chips.

In its early years, Horizon Robotics was far from an overnight success. Yu Kai often recounts how difficult the first 5+ years were – “like walking through a dark tunnel with no end in sight”, as he put it . The company had no chip to show for a long time; initially it survived by doing AI software projects on third-party hardware. For example, Horizon’s tiny team built smart vision modules using off-the-shelf chips to help appliance makers (like air conditioner companies) add AI features . This consulting-like work brought in a bit of revenue, but it was a far cry from Yu’s lofty goal of creating the “next-generation computing platform”. Many in the semiconductor industry were skeptical – here was a software guy with no chip design experience claiming he’d make world-class automotive AI chips. To them, Horizon looked like just another AI algorithm startup doing demos on Nvidia GPUs; the gap between Yu Kai’s bold rhetoric and the reality (a startup with a few dozen employees taking on giants) was glaring .

Despite the doubts, Yu Kai managed to persuade investors to back his vision of “software + chip” for smart cars. An early validation came in late 2017 when Intel Capital led a $100 million Series A+ funding into Horizon . That infusion, along with investments from Chinese funds like Morningside and Hillhouse, gave Horizon the resources to develop its own silicon. By 2019, Horizon reached a milestone: it launched the Journey 2 chip, China’s first automotive-grade AI processor for driver assistance . The Journey 2 was modest in power (around 4–5 TOPS), but it proved Horizon’s concept of a vehicle-specific AI chip. The company followed up quickly with Journey 3, and by 2020–2021 it introduced the more powerful Journey 5, boasting 128 TOPS, aimed at high-speed highway ADAS . This rapid iteration was possible only because Horizon had, from the start, invested heavily in R&D – reportedly on the order of hundreds of millions of RMB per year – even when it meant burning far more cash than they earned . Yu Kai’s philosophy was clear: focus on the “hard but correct things” and build for the future, rather than chase easy wins .

A turning point for Horizon came with an unlikely partnership. In late 2020, Li Auto, a rising Chinese EV maker, needed an ADAS compute solution on short notice (its initial supplier Mobileye wasn’t working out). Horizon seized the opportunity. Li Auto and Horizon engineers worked side by side, swapping in Horizon’s Journey chips and re-writing software in a matter of months . By May 2021, Li Auto rolled out a production OTA update enabling enhanced driver assistance powered by Horizon’s Journey 3/5 chips – an almost unheard-of turnaround time. The car, Li Auto’s flagship Li ONE SUV, became a blockbuster seller in China’s EV market . Li Auto’s founder Li Xiang later publicly thanked Horizon, saying “China has hope because of companies like Horizon”, a praise Yu Kai treasures as a validation of his team’s value . This success with Li Auto established Horizon as a credible player in mass-production ADAS. It was now the only Chinese company with homegrown autonomous driving chips in real cars on the road – a significant bragging right.

After Li Auto, almost every Chinese automaker came knocking. By 2022–2023, Horizon had design wins or strategic partnerships with BYD, Chery, SAIC, Changan, Geely, Great Wall, FAW – essentially all the major domestic OEMs– for their upcoming intelligent models . In many cases Horizon became the sole Chinese chip supplier alongside possibly one foreign alternative, making it a favored “local champion” for brands aiming to reduce reliance on foreign tech . Horizon’s business model is B2B (selling to automakers or Tier-1 suppliers), so these pre-production “design-ins” are critical. According to the company, by the end of 2024 it had secured over 310 vehicle models that will use its chips, with over 200 models already in production and 8 million+ Horizon-powered units on the road . In other words, roughly one out of every three intelligent cars sold by Chinese brands in recent years has a Horizon computing platform inside . This gave Horizon an estimated 33.97% market share in ADAS compute platforms for Chinese-brand passenger cars – firmly #1 in its domestic segment, ahead of any foreign competitor in those vehicles .

Another major boost came from an international partner: Volkswagen. In October 2022, Volkswagen’s software unit CARIAD announced a landmark deal with Horizon: VW would invest $1 billion into Horizon and form a joint venture (with VW controlling 60%) to develop ADAS for the Chinese market . The total commitment, including the JV’s funding, was reported as €2.4 billion – an unprecedented sum for a collaboration between a global automaker and a Chinese tech startup. This partnership (the Carizon JV) essentially made Horizon a key supplier for VW Group in China, integrating Horizon’s chips and software into future Audi, Porsche, and VW models in the country. For Horizon, it not only meant capital and business, but also validation on the global stage: if a powerhouse like Volkswagen was betting on Horizon’s technology over established players, it signaled that Horizon had truly arrived.

All these developments culminated in Horizon Robotics going public. In October 2024, Horizon listed on the Hong Kong Stock Exchange (ticker 9660.HK) in what was heralded as the largest tech IPO in Hong Kong in three years . The IPO raised about HK$5.4 billion (~US$700 million) , valuing the company around HK$50 billion (~US$6.4 billion). On its first trading day, Horizon’s stock jumped over 25%, reflecting high investor expectations . The successful listing was described by Yu Kai as Horizon’s “coming-of-age ceremony” – a validation that the once-doubted startup had matured into an industry leader . As of early 2025, Horizon’s market cap hovers around HK$47.5 billion . (The stock saw a post-IPO dip, slipping slightly below the IPO price amid broader market volatility, which drew attention to Horizon’s financial challenges – more on that later .) Still, the IPO equipped Horizon with fresh funds to fuel its growth just as its newest products (like Journey 6 and HSD) are poised to enter mass production.

From a garage-style startup in 2015 to a publicly traded “unicorn” in 2024, Horizon’s journey has been dramatic. The company navigated early skepticism, forged alliances with both domestic and foreign auto giants, and relentlessly improved its core chip technology (the Journey series, now on its 6th generation). It’s worth noting that Horizon’s strategy has been remarkably consistent: focus on automotive AI computing, combine custom chips with AI algorithms (a strategy now widely emulated), and partner deeply with OEMs rather than try to do everything alone. This focus and depth of collaboration has paid off – Horizon is now entrenched in the supply chain of China’s booming electric vehicle industry, giving it a strong platform for the future.

The Man Behind the Mission: Yu Kai’s Journey

I first met Yu Kai in 2014, shortly after his return to China. He struck me as humble and humorous—someone who could easily be mistaken for a university professor. Indeed, Yu's background is deeply academic: he earned his B.Sc. and M.Sc. at Nanjing University and a Ph.D. in computer science (focused on machine learning) from the University of Munich in Germany. He went on to conduct research at Microsoft Research Asia and Siemens, and became known as a top machine learning expert with dozens of influential papers. In 2012, drawn by the burgeoning tech scene in China, Yu returned to join Baidu. There, he founded and led the Baidu Institute of Deep Learning (IDL)—China's first deep learning research lab—and was later promoted to Deputy Director of Baidu's overall R&D division. Under his leadership, Baidu made significant strides: Yu's team built Baidu's first self-driving car prototypes, launching China's earliest autonomous driving project in 2013. He even convinced famed AI pioneer Andrew Ng to join Baidu's AI efforts. By any measure, Yu Kai was a rising star in the Chinese tech industry.

Yet, by mid-2015 Yu Kai made a decision that shocked many: he quit Baidu to start his own company, Horizon Robotics . It wasn’t an easy choice – Baidu was the “Google of China” and Yu was leading cutting-edge projects there. But Yu had developed a strong conviction that Baidu’s approach to autonomous driving wasn’t going far enough. The crux was hardware. “Our old team felt doing hardware was too burdensome,” he told me, referring to Baidu’s management, “but I believed that without hardware advancing together with software, we’d never unlock real AI potential.” This difference in technical vision – hardware-versus-software – was the main reason for his departure . He famously summarized his rationale: “To truly bring autonomous driving into everyday life, we can’t just do the software algorithms; we must also build the computing chips” . With that guiding principle, Yu Kai became, as one article noted, “the first Chinese scientist to leave a pure software role and bet on making AI chips” . At the time, many thought it was career suicide: he had no prior chip design experience, and the task he set out – a full autonomous driving stack, including custom silicon – was incredibly daunting.

The early days of Horizon tested Yu’s resolve. He assembled a small team in Beijing (later also in Silicon Valley) and started pursuing his vision of a “robot brain”. Robots, especially autonomous cars, were the next big computing platform after PCs and smartphones, in Yu’s view . And if that proved true, someone needed to provide them with the “brains” – specialized chips and an AI software platform to run on them . With this narrative, he convinced investors like Linear Capital’s founder Wang Huai and Morningside’s Liu Qin to provide seed funding. “He was pursuing something hard but right,” Liu Qin said of Yu Kai’s mindset in those days . Indeed, Yu deliberately avoided trendy “hot” fields if he felt they weren’t aligned with his long-term goal. “We never want to join any already-hot sector; we hate just following the herd,” Yu told GeekPark in a 2023 interview . Instead, he doubled down on the moonshot of car AI chips, even as contemporaries chased easier applications like face recognition apps or internet AI services.

This maverick approach meant Horizon had to endure years of operating in the red. Yu Kai often says that if you don’t feel like you’re climbing a 90-degree cliff, your goal isn’t big enough . By that definition, Horizon’s goal was massive – and the climb correspondingly steep. From 2015 to 2019, the company spent heavily on R&D (each year burning tens of millions of dollars) with little immediate return . “Almost every day was adversity,” Yu recalled . There were moments of doubt and near-death. At one point, Horizon had to take on some “side gigs” (like the appliance projects) simply to keep the lights on . But Yu’s charisma and clarity of purpose kept his team and investors motivated. “In those days, people thought I was crazy. But an undoubted dream isn’t worth pursuing,” he told me with a laugh, echoing one of his favorite sayings. His investors praise how he balanced idealism with pragmatism: “I saw in him an extreme blend of tech idealism and rational realism,” said Liu Qin of Morningside . Yu knew when to pivot or make tough calls. For example, in 2019 he realized Horizon had spread itself too thin and wasn’t monetizing. In a bold move, he cut the company’s only profitable business line (which was a non-automotive AI product) to focus 100% on automotive . This was risky, but it also stopped the distraction and even reduced some operating costs. “On the surface I axed a money-maker,” Yu explained, “but it freed up resources to attack what I believe is the ‘super track’ of our era: smart electric vehicles” . It’s hard to imagine many CEOs willingly dropping revenue-generating projects to chase a long-term vision, but that is precisely what Yu Kai did.

Yu’s leadership style is also reflected in Horizon’s internal culture. He structured the company with two core teams from the start: one focused on algorithm development and one on chip design . These teams had very different rhythms (software can iterate in weeks, hardware takes months or years per cycle), which often causes tension in other companies. But Yu insisted they work in tandem, forcing a tight integration of their roadmaps. “This is our core advantage – I haven’t seen a second company do it like this,” he said of Horizon’s parallel development of silicon and software . Insiders say Yu fosters a collaborative atmosphere and is surprisingly hands-on for a CEO, often reviewing technical plans and encouraging cross-team problem-solving. At the Shanghai event, his keynote was equal parts stand-up comedy and lecture – he cracked jokes about the trials of city driving, then delved into the nuances of one-stage neural network architectures. This mix of humor and deep tech insight has made him a sought-after speaker at industry forums (he’s a regular at the annual China EV100 conference, where he’s known for candid takes on the state of autonomous driving).

Despite his long-term vision, Yu Kai is not dogmatic. Notably, his stance on when we’ll see higher levels of autonomy has evolved. In 2023, he publicly said that Level 3 autonomous driving (hands-off in some scenarios) might not be achieved for another decade, given the technical and regulatory hurdles. But by early 2025, his outlook had brightened: “Regulations are coming together, and AI is advancing faster than I ever imagined,” he told Xinhua News, “I now believe in 3 years we might achieve ‘no-hands’ driving, and in 10 years perhaps even go wherever we want autonomously” . What changed? Yu cites the explosion of AI capabilities (like better perception and decision algorithms, partly influenced by large AI models in other domains) and positive moves by the Chinese government to allow testing and deployment of L3 systems . This optimism underpins Horizon’s current roadmap – the company is pushing its HSD solution as a bridge to L3, confident that policy will permit L3 driving on Chinese highways in the next year or two, at which point Horizon’s customers can upgrade from HSD (L2+) to true L3 with over-the-air updates on the same hardware.

Talking to Yu Kai, one comes away sensing both his passion and humility. He often deflects credit to his team or even to the broader industry trends. But the story of Horizon Robotics is inseparable from Yu Kai’s personal story. He infused the company with his belief in “软硬结合” – the marriage of software and hardware – and that mantra still guides Horizon at every level . He also set the tone of being a value-driven innovator rather than a mere competitor: “We’re not an inward-looking, ‘involution’ company,” he said, using the Chinese term “内卷” for cutthroat competition . “We’re about creating new value, expanding the boundaries.” That forward-looking ethos has won Horizon respect even from rivals. As China’s autonomous driving sector grows, Yu Kai has become a bit of a folk hero – a scientist who turned entrepreneur to blaze a new trail. And as Horizon enters its tenth year, it’s clear that Yu’s journey – from academia to Baidu to Horizon – has only just reached its most exciting stretch.

Taking on the Tech Titans: Horizon vs. NVIDIA

In the world of autonomous driving technology, NVIDIA is the 800-pound gorilla – the California-based graphics chip giant whose GPUs have powered everything from video games to data center AI, and, increasingly, smart cars. It’s only natural that Horizon Robotics, as China’s leading autonomous driving chip company, is often compared to (and pitted against) NVIDIA. The reality is more nuanced: Horizon and NVIDIA are both competitors and, in some ways, kindred spirits. Both companies offer high-performance system-on-chips (SoCs) for automotive AI and both provide an accompanying software ecosystem. In fact, one industry analysis noted that Horizon’s approach is “very similar to NVIDIA’s model – providing not just chips, but also a development platform, toolchain, even operating system support, i.e. a full-stack solution” . However, there are key differences in their technology, market focus, and the broader strategic context – especially in China.

Chip Performance and Architecture. NVIDIA’s current flagship automotive chip, the Drive Orin SoC, is widely regarded as the gold standard for Level 2/3 driving computers. It delivers 254 TOPS (trillions of operations per second) of AI compute and is used in many premium cars (for instance, NIO and Xpeng’s latest EVs each have multiple Orin chips onboard). NVIDIA has announced an even more powerful next-gen chip called Drive Thor, slated for 2025, with a claimed 1000+ TOPS of performance . Horizon’s latest Journey 6 series is closing the gap: the Journey 6P chip hits 560 TOPS, which exceeds Orin’s raw compute on paper . It’s the first time a Chinese chip has overtaken a current NVIDIA product in TOPS. Journey 6P achieves this with a 16nm process and Horizon’s proprietary BPU (Brain Processing Unit) architecture, which is optimized for neural network inference . To be fair, NVIDIA’s figure of 254 TOPS for Orin is for INT8 operations; if we compare FP16 or actual workload throughput, the difference narrows. Still, Horizon 6P’s 560 TOPS (likely INT8) is a breakthrough for China’s chip industry, showing the ability to play in the big leagues of car AI chips. Horizon’s previous best, the Journey 5, offered 128 TOPS , so the jump to 6P is significant. One interesting anecdote: some engineers note that Horizon’s effective performance can be quite high because the BPU is designed specifically for vision tasks. In one benchmark, Journey 5 achieved higher frame-per-second processing on image recognition than NVIDIA’s Orin, despite Orin’s higher TOPS, due to Horizon’s specialized optimizations . This highlights a philosophical difference – NVIDIA leverages its general-purpose GPU heritage, whereas Horizon designs more task-specific accelerators. In summary, NVIDIA still leads at the bleeding edge (especially with Thor coming), but Horizon is rapidly catching up for the needs of Level 2/3 systems.

Software Ecosystem and Toolchains. Another major difference lies in the software environment. NVIDIA provides a robust SDK for autonomous driving – DriveWorks and TensorRT for runtime acceleration, and a suite of tools for training and simulation. Many developers worldwide are familiar with NVIDIA’s CUDA programming model. Horizon, being newer, had to build an ecosystem from scratch. It created its own toolchain called “天工开物” (OpenExplorer) to allow customers to train and optimize neural networks for the BPU hardware . Horizon’s toolchain includes compilers, quantization tools, and libraries optimized for their chips. According to a Zhihu analysis, toolchain maturity is a key to success in this field – NVIDIA has the most mature tools, but Horizon has been rapidly improving its OpenExplorer platform, which is freely available to partners . Importantly, Horizon also offers a lot of pre-developed algorithm modules. For example, its Matrix autonomous driving software provides perception, fusion, and planning functions that car companies can use off-the-shelf or customize. With the new HSD system, Horizon is effectively providing a turnkey driving software stack (vision perception, driving policy, control) tightly integrated with its chips. NVIDIA tends to stop at providing the platform and reference algorithms, whereas Horizon is willing to deliver a complete solution (the distinction is blurring as NVIDIA also now offers more full-stack reference implementations). From an automaker’s perspective, some prefer NVIDIA’s ecosystem if they have a strong in-house software team that can leverage it, while others (especially those without large autonomous driving R&D units) appreciate Horizon’s more hand-holding approach – Horizon will work closely with them, even co-develop features, to ensure the system meets local driving needs. This close collaboration is something multiple Chinese OEMs have cited as an advantage of working with Horizon .

Market Position and Strategy. NVIDIA is a global company and its automotive strategy has focused on high-end systems and Robotaxi projects. It famously provided the computing for Uber’s and Google’s early self-driving cars and today supplies chips to the likes of Mercedes-Benz (which plans to use Drive Orin/Thor) and Jaguar Land Rover, in addition to Chinese startups. Horizon, by contrast, has focused almost exclusively on the Chinese market and on mass-market consumer cars. Horizon’s chips are found primarily in cars from Chinese brands, many of which sell in the price-sensitive mid-range. For instance, Horizon’s Journey 3 chip was used in Li Auto’s Li ONE (a ~$50k family SUV) and some trims of Xpeng’s P5 sedan (a ~$25k car), bringing features like lane-keeping and adaptive cruise to those segments. By 2023, Horizon’s customer list included nearly every major Chinese automaker , reflecting a deliberate strategy: be the go-to domestic supplier for anyone building “smart drive” features into mainstream cars. This strategy paid off in volume – as noted earlier, Horizon now holds about 34% share in China’s ADAS computing market for local brands , whereas NVIDIA’s share there is smaller (Mobileye and Tesla’s in-house chips also hold chunks, but Tesla’s are only for Tesla cars) . A 2023 ranking by Gaogong Industry Institute showed the top four providers of autonomous driving compute platforms in China were: Tesla’s FSD chip, NVIDIA’s Orin, Mobileye’s EyeQ series, and Horizon’s Journey in fourth . But that includes all cars (Tesla obviously includes its own chip in huge volume). If we narrow focus to Chinese automakers’ vehicles, Horizon is number one . Part of Horizon’s market success is timing – it was ready with a product (Journey 2/3) just as Chinese OEMs ramped up ADAS deployment around 2018–2020, whereas NVIDIA’s Xavier/Orin were more often slotted into luxury models or came a bit later for the domestic makers.

Another dimension is cost and adaptability. Horizon doesn’t release pricing, but industry experts believe Horizon’s chips undercut NVIDIA’s on price, often significantly. A mid-level Journey 5-based computing unit might cost only a few hundred dollars, whereas an NVIDIA Orin-based unit (including the full board and firmware) can be double or more. Horizon’s simpler configurations (like a Journey 3 for basic L2) can even go into economy car models. This cost advantage is crucial as Chinese automakers in 2023–2024 engaged in intense price wars (spurred by Tesla’s cuts) – they all want to offer better tech features but at lower cost. Horizon positioned itself as the enabler of “smart driving for all”, aligning with efforts by companies like BYD, Changan, and Geely to bring L2+ features into 150k–200k RMB (~$20–30k) cars . For example, in 2023 BYD announced that even its ¥100k (~$15k) electric cars would start coming with advanced driver assistance (BYD dubbed this initiative “Smart Driving for Everyone”) . Such moves are only feasible with a cost-effective local solution – something Horizon is keen to provide. As Yu Kai noted, just a few years ago, ADAS was found only in luxury models; now it’s trickling down to mass models, and Horizon sees its mission as accelerating that trend .

Local Advantage and Partnerships. In China, there’s also a policy and supply chain angle. With geopolitical tensions and U.S. tech export controls, Chinese automakers have grown wary of potential restrictions on sourcing advanced chips from abroad. NVIDIA’s automotive SoCs aren’t currently banned (the bans have hit datacenter GPUs like the A100), but there’s always the specter of future limitations. Horizon, as a domestic company, offers assurance of supply security – an important consideration for state-backed automakers. Moreover, Horizon’s team intimately understands Chinese road conditions, user behavior, and regulations. Urban driving in China has quirks (like the aforementioned “ghost pedestrians” or unmarked lanes in rural towns) that a Silicon Valley-based developer might not prioritize. Horizon has literally driven millions of test kilometers on Chinese roads to fine-tune their algorithms. This local know-how, combined with the willingness to customize, made Horizon particularly attractive for joint ventures and partnerships. The most prominent example is Volkswagen: when VW decided it needed a China-specific ADAS solution, it chose to partner with Horizon over Mobileye or NVIDIA, even investing capital. Analysts noted that “Volkswagen choosing Horizon rather than Mobileye is a recognition of the agility of the local supply chain. Horizon is vertically integrating chip + algorithm + toolchain, using its efficiency and market advantage to rewrite the supply chain structure” . In other words, a giant like VW concluded that to win in China’s fast-moving market, it’s better to go with a nimble Chinese partner who can deliver quickly and adapt, rather than solely rely on a one-size-fits-all global solution.

That said, NVIDIA is not ceding the field. The company has been aggressively courting Chinese EV makers (NIO, for instance, uses 4 Orin chips in its newest ES7 to enable a truly sensor-fusion-rich L2+ system). NVIDIA also opened up its Drive Hyperion platform (reference sensors + compute) which some Chinese autonomous driving startups use for development. And globally, NVIDIA’s sheer R&D muscle means it will continue to push out chips at performance levels few can match – the upcoming Drive Thor with up to 2000 TOPS (some reports even say 2000 TOPS at INT8, which is massive) is aimed at unifying infotainment, ADAS, and even full self-driving on one chip . Horizon’s roadmap likely includes a Journey 7 or equivalent that will need to keep up. This is a classic tech race: NVIDIA with an arguably technology-driven approach, and Horizon with a market-driven approach. Interestingly, Horizon’s strategy of offering a full-stack solution is something even NVIDIA has started to emulate – for example, NVIDIA now offers its own perception software and mapping solutions like Drive Map, and has signaled willingness to do more customization for big clients. It’s a moving target on both sides.

Finally, it’s worth mentioning that Horizon is not alone among Chinese chip challengers. There are others like Black Sesame Technologies (based in Shanghai, known for its “Huashan” AI chips) and Huawei’s Ascend chips for cars, among others. Black Sesame, founded around the same time (2016), has also developed high-TOPS chips (its latest Huashan-2 A1000 Pro is around 106 TOPS and targeting 256 TOPS with dual chips), and has won some deals (it’s reported to work with BYD, FAW, etc.) . But Black Sesame’s volumes and ecosystem lag Horizon’s – by late 2024, Horizon’s market share and automaker relationships were clearly ahead . Huawei, on the other hand, offers an entirely different approach: an integrated solution (MDC computing platform + Harmony OS for cars + sensor suite) which appeals to some automakers who want a one-stop-shop. In fact, some analysts see Huawei and Horizon as more direct competitors in China’s context – both pitch full-stack solutions, both are domestic. But Huawei’s situation is unique (politically charged and Huawei doesn’t currently sell its chips outright to automakers, it bundles them in solutions). Horizon remains distinct in focusing purely on being a supplier.

In summary, Horizon vs. NVIDIA in China is a microcosm of China’s broader tech ambitions. Horizon has leveraged its home turf advantages to capture a large chunk of the Chinese smart car market, providing a competitive, lower-cost, and more China-tailored alternative to NVIDIA’s platform . NVIDIA, however, is still the worldwide leader and isn’t sitting idle in China either. Many Chinese car models actually deploy a hybrid approach – using Horizon chips for some functions or trims and NVIDIA for higher trims, or Horizon for one domain (say, driver monitoring) and NVIDIA for main ADAS – as a way to hedge bets. Over the next few years, as both companies roll out their next-gen silicon (Journey 7? NVIDIA Thor) and as Level 3 functionality emerges, we’ll likely see the competition intensify. For now, Chinese consumers are benefiting from this rivalry: features that were once available only on $100k luxury cars with expensive NVIDIA systems can now be had on a $25k electric SUV thanks to companies like Horizon driving down the cost and collaborating so closely with automakers.

Outlook: Challenges and Opportunities on the Horizon

As Horizon Robotics stands at the forefront of China’s autonomous driving industry in 2025, it faces a future filled with both promise and peril. The overall trajectory of the market is undeniably in its favor: advanced driver assistance and partial automation are quickly becoming must-have features in new cars, especially in China’s hyper-competitive auto market. A few years ago, features like highway NOA (Navigate on Autopilot) or self-parking were limited to luxury models; now we’re seeing a push to make them available even in entry-level vehicles. One forecast estimates that by 2025, around 20% of new Chinese passenger cars will support NOA functionality (L2+/L3 autonomous navigation on highways), creating a 350 billion RMB (~$50B) market opportunity for ADAS and autonomous driving tech . This rising tide could lift Horizon dramatically – as a leading supplier of the “brains” behind these systems, Horizon stands to win a significant share of that multibillion-dollar pie if it continues to execute well.

Industry experts are generally bullish. At a recent forum, Wang Huai, one of Horizon’s earliest investors, remarked that Horizon has done well to “move in step with the times” – capturing the wave of autonomous driving as it transitions “from niche to mass market” . He also noted Horizon’s ability to “move in step with the momentum”, meaning adapting its strategy to larger forces (such as collaborating internationally where appropriate, as with Volkswagen) . In his view, the next 10 years will see a cluster of big companies emerging in this $1 trillion (10万亿人民币) intelligent vehicle market, and Horizon has “opened a very good lead” in the race . That encapsulates the optimism: Horizon is seen as a front-runner in what could be one of the decade’s most valuable tech sectors globally.

Media coverage in China often paints Horizon as a champion of domestic innovation. The successful IPO and high-profile partnerships have become points of national pride. Xinhua News wrote that global investors are “re-evaluating the value of Chinese tech companies” because of cases like Horizon – companies that foreigners assumed were just low-end players, but which are now breaking through in high-tech arenas like smart car chips . Indeed, Horizon’s rise is frequently cited alongside China’s broader advancements in EVs, batteries, and AI as evidence that the country can not only catch up to, but even lead in cutting-edge technology . Internationally, Horizon is also gaining recognition (though more in industry circles than the general public). Its deal with VW was covered by the global press, and at CES and other venues Horizon has started showcasing its tech to foreign automakers. Yu Kai has said that expanding overseas is on the roadmap – “better mobility is a need for all humanity, not just China,” he told state media – but he is cautious, wanting to first solidify Horizon’s base in China and then partner to enter other markets. In Europe, Japan, etc., he sees more potential collaborators than fierce competitors, given few companies globally do what Horizon does . Still, making a mark outside China will be an important next test.

For consumers and the public, Horizon’s impact will be felt through the cars they drive. By late 2025, if all goes to plan, over 100 new car models will launch with Horizon’s Journey 6 chips inside . Many of these will support features like HSD (city assist) or enhanced highway autonomy. This means millions of drivers in China will experience AI copilots that Horizon helped build. The user feedback on those initial deployments will be crucial. If Horizon’s systems are smooth, reliable, and deliver a “wow factor” (say, navigating a complex city intersection on their own), it will greatly bolster Horizon’s reputation. Positive buzz from early adopters could make “Horizon inside” a selling point, much like “Intel Inside” was for PCs – albeit to a tech-savvy subset of buyers. On the flip side, any high-profile failures or safety issues would be a setback not just for Horizon but for the whole ADAS movement. So far, Chinese consumers have been cautiously enthusiastic about ADAS, with surveys showing interest in autonomous features but also concerns about safety. Horizon and its automaker partners will need to educate users and ensure a good human-machine interface (e.g. clear driver monitoring and handoff in L2 systems) to build trust. Yu Kai often emphasizes “user trust” as a key metric, saying HSD is designed to feel so natural that users quickly trust it . That will be tested in the real world soon.

Turning to the challenges, the biggest one is financial sustainability. As of the IPO, Horizon remains deeply unprofitable. Its accumulated losses for 2021, 2022, 2023, and the first half of 2024 amounted to 226.21 RMB (about $33 billion USD) – an astronomical figure, though it reflects heavy R&D investment and accounting for share-based comp, etc. In 2023 alone, Horizon lost around ¥67 billion , far outpacing its revenues (revenue was only a few billion RMB). R&D spending each year was 150–250% of revenue – meaning Horizon spent more than it earned, by a lot, on developing its technology . Clearly, this can’t continue forever. The IPO proceeds help, but to truly thrive, Horizon must scale up revenues significantly (or eventually taper R&D spending growth). The good news is that revenue is growing fast – as its chips go into mass production cars, sales should ramp. The volume commitments it has (20+ carmakers, 100+ models from 2025 on) could propel Horizon’s annual revenue to a new level, potentially turning the corner toward profitability. However, automotive supply deals often have razor-thin margins, especially under price pressure. Automakers will demand cheaper chips each year. Horizon might offset that by selling higher-tier software or maintenance services – a model Mobileye uses by charging per-car licensing fees for its driving policy software on top of chip price. It remains to be seen if Horizon can similarly monetize its full-stack offerings (HSD might be sold as a one-time system fee or per-unit royalty; details are not public).

Another risk factor is customer concentration and competition. As a component supplier, Horizon’s fortunes are tied to its customers’ success. If, say, a major partner like Chery or Li Auto has a slump in sales, Horizon’s chip shipments will also dip. More ominously, what if an automaker partner decides to develop its own chips or switch to a rival? We saw an example: Li Auto was a big early win for Horizon, but for its newer models like the L9, Li Auto opted to use NVIDIA Orin and self-developed software for a more premium ADAS setup (Li Auto still uses Horizon for some models/features, but not at the high end). This shows that as automakers grow, they might seek multiple sources or even in-house solutions. Tesla famously does its own FSD chips; Xpeng has hinted at developing proprietary AD ASICs in the future. If a wave of automakers goes the Tesla route, that’s a long-term threat to Horizon (though for now, most seem content to buy rather than build). A related point is that Horizon’s lead among domestic players isn’t unassailable. Companies like Black Sesame have been nibbling at niche projects (e.g., supplying chips for a Dongfeng Robotaxi or certain BYD models) . While Horizon’s market share is higher, Black Sesame’s emergence shows there is room for competition, and it has strong backing (e.g., Bosch has collaborated with Black Sesame). Huawei poses another competitive threat: its Intelligent Automotive Solutions unit offers the MDC computing platform (with Huawei’s own AI chips) as part of a broader package (including HarmonyOS Smart Cockpit and sensors). Some Chinese carmakers (e.g., Arcfox / BAIC, Avatr / Changan partnership) have chosen Huawei’s full-stack ADAS solution instead of piecing together chips and software themselves. Huawei’s approach can be seen as an alternative to what Horizon+OEM would do. However, Huawei’s presence is complicated by political factors and by the fact that not all automakers want to cede so much control to Huawei. In contrast, Horizon positions itself as a pure supplier/enabler, happy to be behind the scenes and let car brands shine – which some OEMs prefer.

On the technology front, the pace of innovation remains relentless. Horizon will need to maintain a high R&D cadence to keep up with Nvidia, Mobileye, Qualcomm, Tesla, and others. For instance, Mobileye (which historically led the L0-L2 ADAS market) is fighting back in high-compute chips with its upcoming EyeQ Ultra (176 TOPS) and a 2025 roadmap beyond that . Qualcomm is pushing its Snapdragon Ride platform, targeting 1000+ TOPS by combining multiple SoCs. Tesla, while not selling its FSD chip, is constantly improving its in-house silicon and software and could license its full-stack tech to other automakers down the line. This means Horizon has to keep investing in R&D at a high level. The “chip + algorithm” co-design challenge also gets harder as systems scale up – effectively, Horizon now competes in AI compute (with chip giants) and AI algorithms (with driving software companies) simultaneously, which is a lot to juggle. So far it has managed, but moving from L2 to L3 to L4 will require new breakthroughs (for example, more powerful chips, more sophisticated planning AI, functional safety at higher levels, etc.). Yu Kai’s strategy to remain an “outward-expanding” company – not just fighting over existing market, but creating new value – will be tested as the market matures and more players enter.

One should also consider the macroeconomic and regulatory environment. The Chinese government is very supportive of autonomous driving, with policies to allow testing and even limited Level 3 deployment (certain cities in China are now piloting L3 driving in traffic jams, for example). This regulatory green light is a boon for Horizon and automakers. However, there’s also the global environment: U.S. sanctions on AI chips could tighten. So far, Horizon uses 16nm TSMC fabs for its chips – not cutting-edge enough to be restricted like 7nm chips, but if rules change, Horizon might need to pivot to domestic fabs (which are improving but still behind a bit in process tech). Also, if Horizon tries to sell to overseas clients, there could be geopolitical scrutiny (similar to how Huawei faced challenges). These factors are uncertain but lurk in the background.

Despite challenges, the opportunities for Horizon likely outweigh the risks at this juncture. The company expects that by the end of 2025 its total Journey chip shipments will surpass 10 million units, making it the first Chinese autonomous driving tech company to reach that scale . Achieving that will mean a large and growing installed base, which can feed a positive feedback loop of data and improvements. Every car on the road with a Horizon chip potentially sends back anonymized data on edge cases (if the automaker allows), helping Horizon refine its algorithms – a strategy Tesla leveraged masterfully. Horizon is starting to get those network effects at scale. Moreover, Horizon’s successful IPO and prominent role might enable it to attract even more top talent (the competition for AI experts is fierce, but being a market leader helps in recruiting).

One notable external validation came just recently: at the 2025 Shanghai Auto Show, analysts and attendees were impressed by Horizon’s live demos, with some saying HSD’s performance in complex urban traffic was on par with (or even better than) some well-known foreign systems. “Three years ago, I couldn’t imagine that today Horizon SuperDrive, using just 11 cameras, can freely navigate the busiest downtown streets of Beijing and Shanghai,” Yu Kai observed, reflecting on how quickly their tech had matured . Indeed, if Horizon can reliably achieve vision-only urban navigation (a Tesla-like feat but in the far more chaotic Chinese city environment), it would be a leapfrogging moment.

Looking ahead, Horizon’s endgame seems to be to become a platform/ecosystem leader for intelligent vehicles, not just a chip supplier. The comparison to Android in smartphones or Windows in PCs has been made by some Chinese commentators. Horizon’s full-stack approach could, if widely adopted, form an “operating system” of sorts for smart driving that many brands use (especially those without their own large ADAS teams). If Horizon can maintain technological parity with the global best while leveraging its local ecosystem, it could indeed become the default choice for many automakers in China and possibly other emerging markets looking for an autonomy solution. There’s also the potential to extend its technology to other domains: Horizon started with a broad “AI for IoT” vision (hence the company’s full name “Horizon Robotics” – implying robotics, not just cars). We may see its BPU architecture applied in robotics, smart infrastructure, or other autonomous machines. For now, though, vehicles are more than enough of a canvas – China alone produces 20+ million cars annually, all rapidly adding “smart” features.

In closing, as a tech journalist who has followed Horizon since its scrappy beginnings, it’s remarkable to see how far it has come. The Shanghai SuperDrive launch felt like a victory lap for Yu Kai and his team – but also the starting gun for the next phase of competition. Horizon now stands at the “horizon” of a new era (to borrow its namesake imagery): the era when intelligent driving goes from demo to daily reality. The company’s success will depend on navigating that transition, scaling up production, satisfying both automakers and end-users, and staying ahead in innovation. Challenges abound, from turning a profit to fending off strong rivals, but opportunities beckon, with a massive home market and supportive tailwinds driving the adoption of autonomous tech. If Horizon Robotics can drive safely through the upcoming twists and turns, it may well solidify itself as not just a Chinese champion, but a global leader in automotive AI – steering the industry toward a future where, truly, we can “leave the driving to the robots” and enjoy the ride.