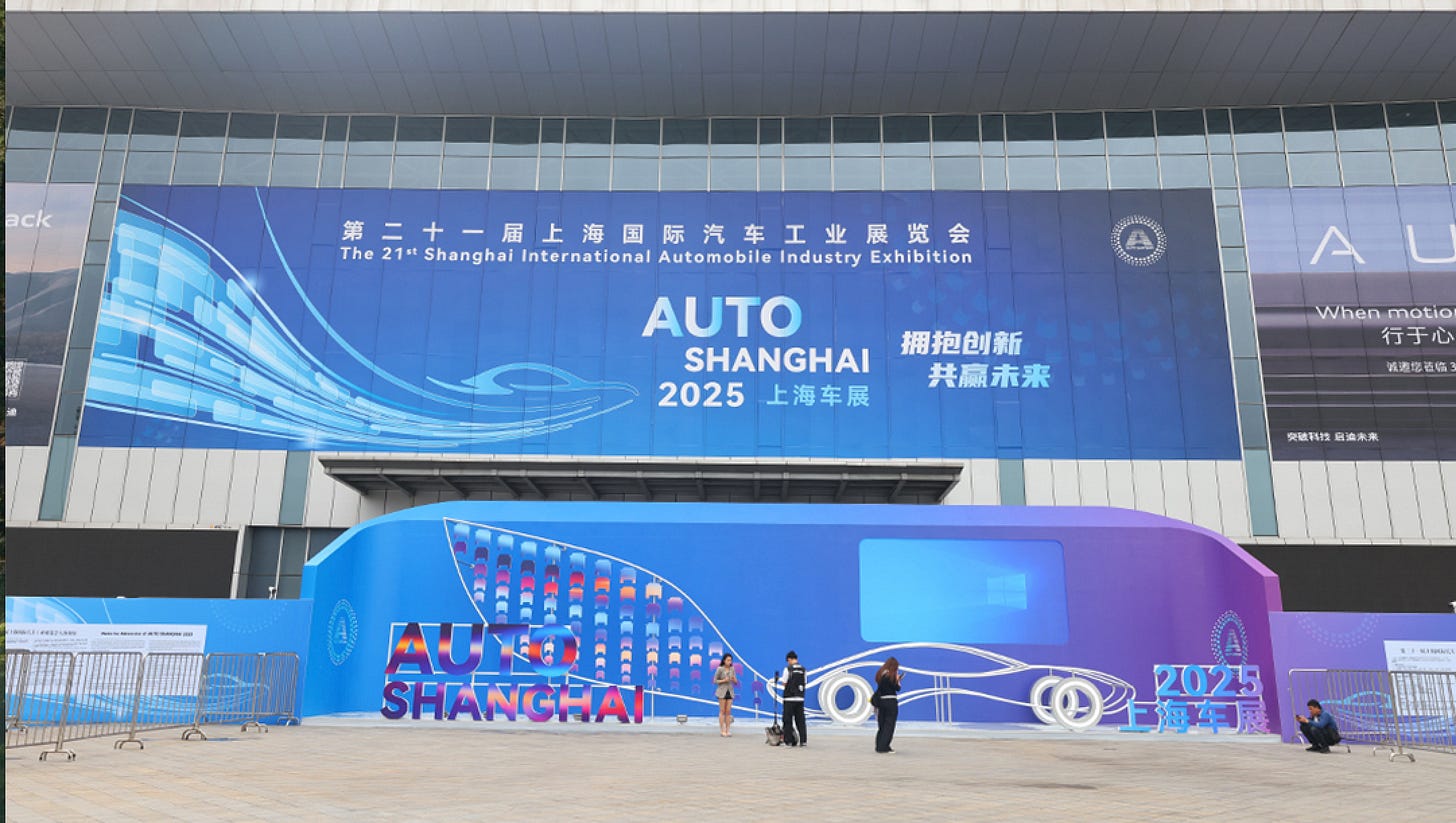

Reflections from the 2025 Shanghai Auto Show: China's Automotive Turning Point

An Industry Transformed: My Firsthand Impressions

As I entered the bustling halls of the 2025 Shanghai International Automobile Exhibition, the energy was palpable. Thousands of visitors, including a remarkable number of international attendees, gathered enthusiastically around Chinese automotive booths. I observed firsthand the fascination and respect from foreign media, analysts, and auto enthusiasts who meticulously examined every detail of China's latest automotive innovations.

Gone were the flashy celebrity endorsements and superficial attractions of past shows. Instead, the focus firmly rested on groundbreaking vehicles and transformative technologies, signaling a mature shift towards serious technological competition. It was immediately clear: China is now shaping, rather than merely reacting to, global automotive trends.

Collective Technological Prowess

Walking through the exhibition, the collective strength of Chinese automotive brands was striking. NIO captivated visitors with its advanced battery-swapping infrastructure and sophisticated autonomous driving systems. Meanwhile, Xpeng proudly showcased its newly developed “Turing” AI automotive chip, promising mass adoption and L3 autonomous capabilities by year-end, challenging traditional auto giants.

Huawei, with its holistic automotive solutions, underscored this shift even further. Its intelligent driving platforms, prominently featured across multiple brands, highlight China’s deep integration of ICT into mobility. Moreover, China's burgeoning semiconductor sector, which was prominently represented, demonstrated significant progress in automotive chip self-sufficiency. Seeing domestically produced chips integrated into European vehicles was a stark reminder of how quickly China has climbed the technology ladder.

Geopolitical Realities: The Backdrop of Transformation

This technological ascension is set against a complex geopolitical backdrop. Intensifying US–China tensions, driven by tariffs and technology export controls, have reshaped supply chains and trade flows. Europe's ambitious climate policies, particularly the EU Green Deal, have paradoxically opened doors for competitively priced Chinese electric vehicles (EVs), even as trade frictions rise with Europe’s ongoing anti-subsidy investigations.

The aftermath of COVID-19 and semiconductor shortages further accelerated strategic shifts in global automotive supply chains. Automakers are increasingly near-shoring or friend-shoring to protect against geopolitical risks and economic disruptions, exemplified by the United States’ Inflation Reduction Act promoting domestic battery production.

Keep reading with a 7-day free trial

Subscribe to Pandaily to keep reading this post and get 7 days of free access to the full post archives.