Community Group Buying Becomes New Way to Tame Rising Pork Prices

Want to read in a language you're more familiar with?

Chinese e-commerce platforms are thinking about new ways to help consumers obtain cheaper pork. And the online community group buying model is one of the ways.

Chinese e-commerce platforms are thinking about new ways to help consumers obtain cheaper pork. And the online community group buying model is one of the ways.

It allows a group of residents in the same neighborhood to get discounts by buying together in bulk through e-commerce. Internet companies including Pinduoduo, China’s biggest agricultural e-commerce platform, Alibaba Group, and Meituan, the largest daily services platform, have also started their community group buying services.

Pork is the main choice of meat for consumers in China and prices have been going up because of swine flu, rising demand and costs of feedstock.

Pork now retails at 62 yuan ($9.1) per kilogram, compared with the ex-farm price of 44 yuan ($6.5) per kg, according to industry figures. Most of the costs are added by wholesalers and supermarkets or farmers’ markets, as production is dominated by backyard farmers who are dependent on intermediaries to link up with slaughterhouses and supermarkets.

Community group buying can be the answer to getting rising pork prices under control, by cutting out intermediaries and reducing distribution costs. These costs make up 40% of the retail price, according to an industry estimate.

Community buying is booming in China. There were around 100 community group buying platforms as of December 2018, according to consulting firm iResearch.

Group-buying platforms could work with top producers such as COFCO Meat Holdings Limited., connecting them directly with slaughterhouses to reduce the costs added by pig traders and supermarkets, the report says.

Prices were up over 50% in August from a year earlier, and are a major driver of food inflation. Rising pork and corn prices, along with a recovery in domestic demand and a drop in supply due to African swine flu, have pushed up all animal protein prices, according to the National Bureau of Statistics.

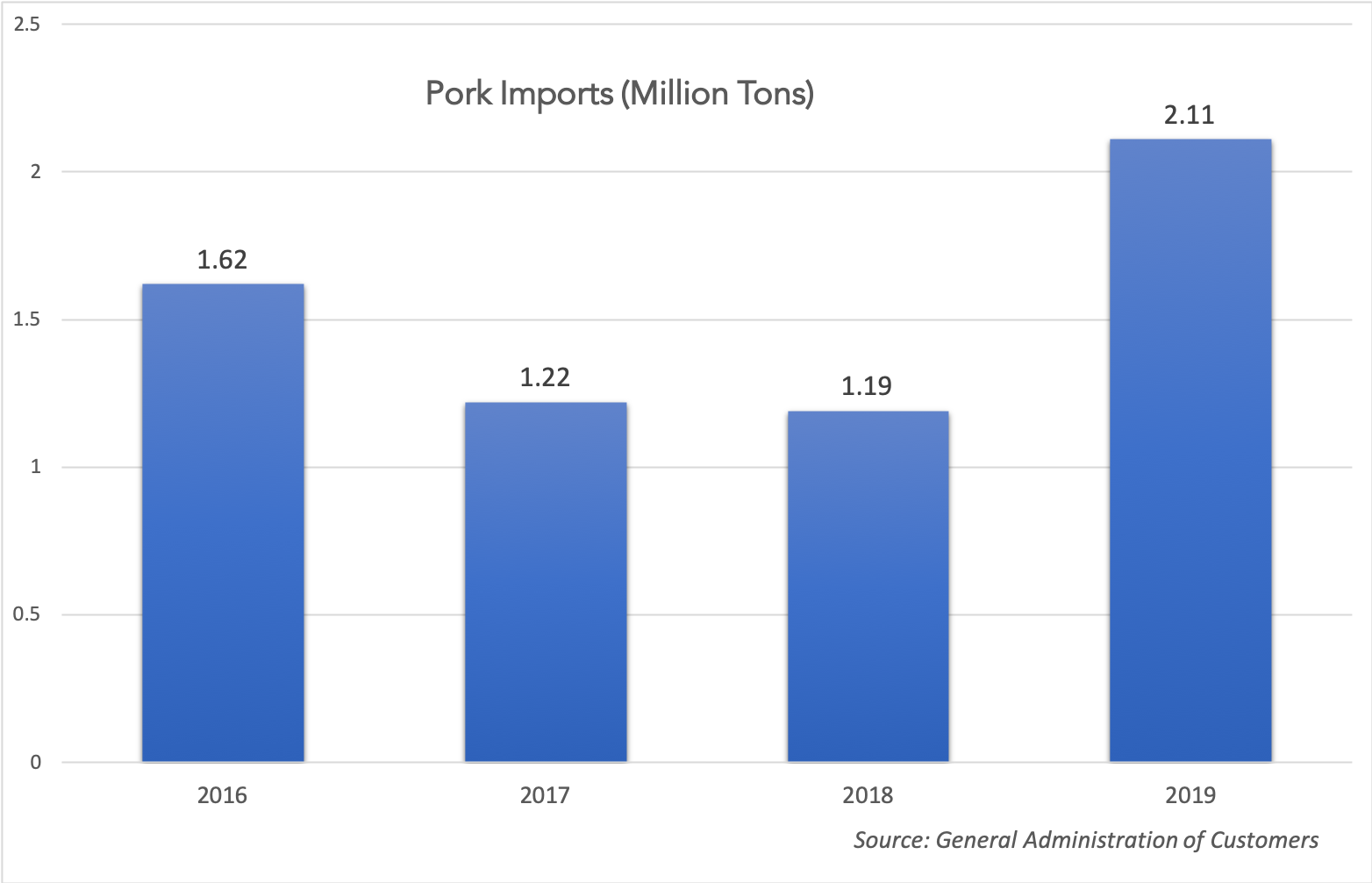

China is the world’s largest consumer of pork. Last year, total pork consumption reached 1.3 trillion yuan, comparable to total retail sales of apparel. Chinese pork imports jumped 75% to a record 2.11 million tons in 2019 as the government sought to curb prices after African swine flu ravaged herds.