Global Smartphone Market Sees Strong Recovery in Q3, Samsung tops, Followed by Huawei

Want to read in a language you're more familiar with?

South Korea’s Samsung reclaimed the top spot, replacing Huawei whose shipments slumped domestically and globally. Huawei, Xiaomi, Apple and Vivo ranked two to five, respectively.

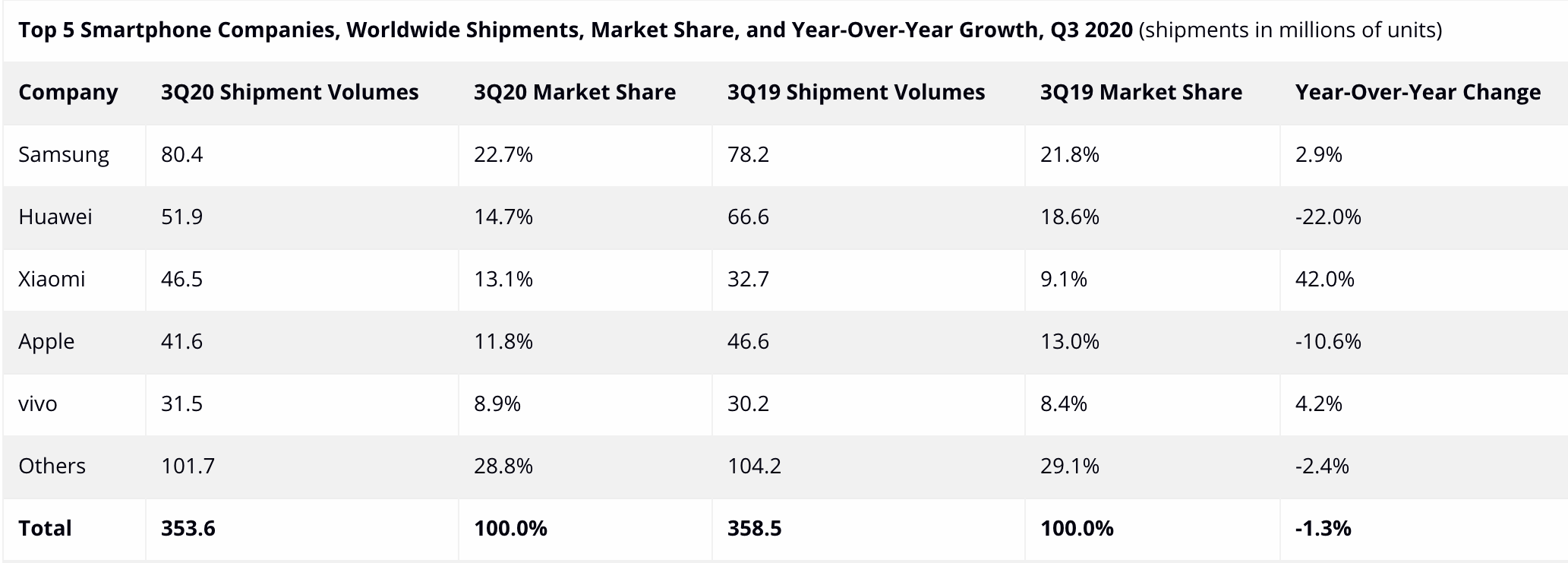

The global smartphone market saw strong recovery in the third quarter of 2020, with shipments declining only 1.3% year over year, in contrast to the much worse numbers in this year’s first two quarters, according to preliminary data from the International Data Corporation (IDC). South Korea’s Samsung reclaimed the top spot, replacing Huawei whose shipments slumped domestically and globally. Huawei, Xiaomi, Apple and Vivo ranked two to five, respectively.

With global economies gradually reopening and restrictions relaxing, the worst time for the smartphone market has passed, it seems. In total, 353.6 million smartphones were shipped during the third quarter. The market rebounded faster than IDC's previous prediction of a 9% year-over-year decline, as the market declined 11.7% year on year in the first quarter, and 16% in the second quarter.

SEE ALSO: Huawei Mate 40 Series to Be First Smartphone to Support China’s New Digital Yuan

Samsung reclaimed the top position after being replaced by its rival Huawei in the second quarter, with a market share of 22.7% and 80.4 million smartphone shipments, up 2.9% year over year.

Huawei dropped to second place in the third quarter with 51.9 million smartphones shipped and 14.7% market share, down 22% year over year. The Chinese tech giant has suffered a great slump in international markets and a notable drop of more than 15% in China, largely due to the continued US sanctions that have been cutting the company’s chip supplies.

Xiaomi beat Apple for the first time and ranked third with a 13.1% market share and 46.5 million devices shipped, up 42% year on year. Its strong presence in India, the second-largest smartphone market globally, played a significant part in Xiaomi’s progress. The company launched its low-end Redmi 9 series in June, which did well in both India and China.

“In India, distance learning has actually boosted the demand for low-end smartphones as they are a more affordable option compared to tablets,” said Nabila Popal, research director with IDC's Worldwide Mobile Device Trackers.

In India, Xiaomi regained nearly 85% of its pre-pandemic production capacity, which helped fulfill the high demands.

In addition to its low-end Redmi 9 Series, Xiaomi stepped up with different tiers of lineups including the mid-range Redmi K30 Ultra and high-end MI 10 Ultra in China, which accounted for more than half of the brand’s global shipments. Xiaomi is also the only company that saw a shipment growth among the top five smartphone manufacturers in China’s market – Huawei, Vivo, OPPO, Xiaomi and Apple.

Apple’s lack of new smartphones in the third quarter mainly contributed to its lackluster performance. But with its much-anticipated iPhone 12 series launch in October and November, the company could expect an upsurge in the fourth quarter’s global shipments.