Here is What You Need to Know About Douyu, Chinese Streaming Unicorn Eyeing US IPO

China in all respects is a game streaming Eden. With a vast population and prodigious strides in tech, it will hardly run out of young virtual reality pundits willing to show off their gaming skills online in the near future.

China in all respects is a game streaming Eden. With a vast population and prodigious strides in tech, it will hardly run out of young virtual reality pundits willing to show off their gaming skills online in the near future. The local market is not only massive, but also way more inclusive than that of the West. Women here consistently outrun men in the amounts of donations they get from viewers and are generally met with more encouragement as opposed to toxicity they have to deal with on European and American platforms. Same goes for mobile games that in the West are often not even regarded as real games by old-timer geeks.

SEE ALSO: Ep. 43: Douyu’s IPO, Panda.TV’s Death — Let the Gaming Live-Streaming Games Begin

In fact, in 2018, six out of ten most streamed games on Chinese platforms were mobile games, while Twitch, the global live-streaming behemoth, had none. Over the quarter of China’s burgeoning streaming market is currently occupied by gaming streams, a vertical worth roughly $2 billion in and off itself. Amidst this expanding goldmine is Douyu, one of the top two streaming unicorns in China, who is eyeing a US IPO with an expected market cap of over $4 billion.

It’s been a few months since Douyu International Holdings, the company behind arguably China’s largest live-streaming platform, announced its IPO plans. The spirited rhetoric was, however, swiftly dropped in the face of possible Trump administration tariffs on Chinese companies. But as Trump’s mood swings back to normal, and clamorous tariff chitchat is relinquished, Douyu is trying to jump on the opportunity and finish what it has started.

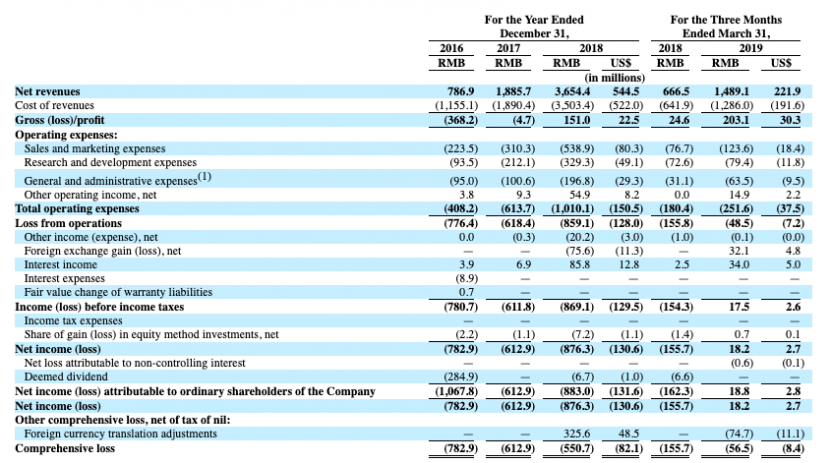

In an updated IPO prospectus filed on July 8, Douyu reported a profitable first quarter of 2019 with total revenues soaring 123.4% year on year to RMB 1.49 billion. The company has also reported a significant spike in paying users to over 6 million, making it number one in that metric and toppling its nemesis Huya from the pedestal. Douyu also finally managed to make some profits, earning RMB 18 million, which is not half bad, considering it reported a net loss of RMB 876.3 million on revenue of RMB 3.65 billion in 2018, with similarly poor results in 2017.

Douyu also beat Huya in monthly active users (MAUs), with a 25.7 percent upswing year on year to 159 million, and it is still ahead in hooking up star game streamers to its platform. According to iResearch, Douyu has signed over 50 top names in livestreaming, which includes 10 of the most popular streamers in China. Hu

And now the big shot streaming unicorn backed by Tencent is preparing to go public offering a total 67.4 million shares priced between $11.50 and $14.00 each. The company claims 32,462,368 ordinary shares will be outstanding after the IPO, which means that its valuation could be somewhere between $3.73 billion and $4.54 billion.

Douyu started its foray onto the game streaming summit as an outgrowth of ACFun, a video sharing site founded in 2007 that overlaid user comments on its content (mostly anime cartoons) providing real-time viewer reactions to videos. It made watching videos way more interactive and, in many ways, laid the foundation for live-streaming. The website became an incubator for several prominent online start-ups, among which Bilibili, China’s answer to YouTube, and Douyu.

Douyu founders Chen Shaojie 陈少杰 and Zhang Wenming 张文明 initially started a platform called Zhangmenren 掌门人that allowed gamers to compete online. Shortly, they sold it to gaming giant Shanda, but Chen Shaojie stuck around to run the business. The company bought ACFun for a bit over half a million dollars and in 2012 repurposed it for video-streaming after Chen witnessed the rise of Twitch in the West. In January 2014, the gaming part of ACFun officially spun off and became Douyu, which literally translates as “fighting fish”.

However, the vigilant attitude that the name projects didn’t help Douyu break through. The start-up tottered from one small investment to the other raising an angel round of $3million solely backed by the founders’ reputation of serial entrepreneurs. Yet, according to Chen, that only lasted the company two months of bandwidth costs.

Nonetheless, It didn’t take long for Sequoia Capital to see the potential behind Douyu’s business model and invest $20 million in the company, which, according to Chen, was prompted by Amazon’s billion dollar acquisition of Twitch. The new market dynamic made fundraising significantly easier and pushed the Wuhan based Douyu into the Unicorn league just two years after its separation from ACFun.

SEE ALSO: For more on Game-centric live-streaming listen to our podcast TechBuzz China

Douyu’s biggest competitor Huya went through a similar rite of passage. Starting in 2012 as a gaming division of YY, one of the leading live-streaming platforms in China, it continued as an independent business in 2014, after attracting 30 million MAUs and earning $20 million in annual revenues in just a year.

While bested by Douyu in total MAUs, for most of its history, this Guangzhou platform was on top of its Wuhan competitor in pretty much every other statistic, be it paying users, revenues or profitability. Ergo, it is no surprise, that Huya was also first to file for an IPO. The significant portion of Huya’s success comes from Douyu’s inability to capitalize on China’s booming mobile gaming market in 2016 and 2017, but the Wuhan company seems to have caught up since then, rapidly rising to number one in the field.

Sadly, number one in China is still pretty far from number one in the world. While often compared to Amazon-owned Twitch, Douyu is hardly a challenger to the American streaming giant. The Chinese company is fully dependent on user tips and virtual gifts (of which streamers get only 30-40 percent) to make revenue, while Twitch makes use of several cash streams like tips, advertisements and subscriptions. To compare, according to Bloomberg, Twitch was expecting to amass $1 billion in advertisement revenues in 2018. Douyu, on the other end, made only $73 million.

The coming IPO, while thrilling, has, however, aroused concerns on investors’ part. Many doubt Douyu’s potential for further growth and cite the company’s loss-making 2017 and 2018 as an indicator of a dot-com style bubble that might be where all the current unicorns are slithering. Huya is a tough competitor to boot. The Guangzhou company is already taking action by signing contracts with top European e-sports teams to expand its business to the West and establishing R&D focused tech subsidiaries. Not to mention that Douyu will need to readjust its business model to open up new revenue streams. The “fighting fish” had better make sure that it’s not jumping in this IPO tug-of-war at the deep end.