Live Streaming E-Commerce: Get Onboard Before It's Too Late!

The boom of live streaming e-commerce in China is best understood as an outcome of layers of factors, some are particular to the history of Chinese e-commerce, others universal for any Internet companies in need for commercialization.

“There are about seven opportunities to get rich in one's lifetime, and TikTok is undoubtedly one of them!”

In an article titled “Three Billion Global Users, Second Boom For Livestream E-commerce”, TikClub, a Guangzhou-based marketing company preached to its readers about their last chance to get rich in 2021: TikTok livestreaming e-commerce.

Despite the suspicious flamboyance, or the fact that Tiktok has only 1 billion monthly active users as of September 2021, instead of three billion, the boastful title may have indeed captured the current feeling in the industry — live streaming e-commerce is on the rise, globally.

Given the mounting pressure that Chinese cross-border e-commerce merchants encounter on other platforms such as Amazon, which began purging Chinese sellers earlier this year, live streaming e-commerce on social media platforms such as TikTok is indeed tempting.

Everyone is going for it

At the International E-business Expo held in Hangzhou on October 16, industry insiders expressed near unanimous optimism about the rise of the industry. Wu, the business development manager for Shopline in eastern China, spoke with Pandaily, “Given the huge success of live streaming e-commerce in China, I think it’s only a matter of time for it to boom in the overseas market”.

Another Expo attendee echoed the sentiment but placed the most weight on TikTok, “I mean, TikTok is going for it. It has to be something big, right?”

Yes, Tiktok has been going for it aggressively. According to YiMagazine, in June 2020, Tiktok’s parent company Bytedance established an e-commerce division labelled as “P1”, the top priority level. In October 2020, the short-video app partnered with e-commerce platform Shopify and tested live streaming shopping service in the US, Canada and the UK. Then, in December 2020, TikTok further partnered with Walmart in an event called “Holiday Shop-Along Spectacular”, where TikTok influencers — some with over 43 million fans — shared their favourite Walmart product via their live-streams while users could add items to their TikTok shopping cart.

The launch of a “Seller University” by TikTok in Indonesia in February 2021, and the rapid expansion of e-commerce related features such as the “live shopping carts” in the Middle East and Europe suggests the video-sharing app is eyeing the global market for its live streaming e-commerce business.

But so is Facebook, Instagram, Amazon, and an array of other social media sites as well as e-commerce platforms. Amazon, for example, launched the “Live Creator” app in 2019, which allows merchants to sell via live stream directly from their phone. In July 2020, Amazon introduced the “Influencer Program”, encouraging content creators to “inspire customers” by showcasing and recommending products via live stream.

As the most popular social media app in the world, and with its e-commerce experience in China — the birthplace of live streaming e-commerce — will TikTok be able to live up to its faithful believers’ expectations and successfully sell the business model to overseas markets? An examination of live steaming e-commerce's development in China may provide some clues.

China’s Livestreaming E-commerce Boom

The rise of live streaming e-commerce in China can be roughly traced back to early the 2010s following the advancement of Internet infrastructure including 4G technology and big data technology. The new style of broadcast was also made possible by the rapid penetration of smartphones among the population, which, by 2020, had reached 63.8% with more than 1.2 billion 4G users in total.

As a result, social media and short-video platforms such as WeChat and Douyin (TikTok’s Chinese version) have become the most popular and accessible apps for Chinese netizens to kill time with. Naturally, content platforms like these attract more attention and traffic than traditional shopping platforms, such as Alibaba’s Taobao.com, prompting the latter to “content-ize” itself so as to regain lost potential customers.

In 2016, Taobao launched “Taobao Live”, where sellers’ showcasing their products to viewers via livestream became the new form of content (relative to product information in the form of texts and images) on traditional e-commerce platforms. This content-ization — realized through live stream — transforms the traditional way of online shopping where users go to the platform, search for a product and make a purchase into a new model wherein live streamers generate content, the platform distributes it, and users invent, discover and share their needs as they endlessly browse pages of tailored content made possible by big-data technology. In this process, live streamers, with just the right balance of honesty and enthusiasm, become a trustworthy guide navigating users through the dazzling online marketplace. A shift to content-based e-commerce thus also helps platforms and brands to create a stronger customer stickiness as they develop trust through watching certain live streamers.

The combination of livestream and e-commerce proved to be a defining moment in the history of e-commerce. According to iiMedia Research, from 2017 to 2018, Taobao's livestream sales rose from 20 billion yuan ($3.13 billion) to an astonishing 100 billion yuan ($15.64 billion), a 500% year-on-year growth.

It didn’t take long for social media platforms to catch on. Social media platforms like Douyin have a huge advantage over shopping platforms in terms of Internet influencers and the traffic they brought to the platforms. It is important to remember that social media sites are first and foremost “social”, and with the help of algorithms, they allow for the rapid spread of information among friends, communities, and eventually, a national, even global audience — a perfect mechanism for marketing.

Prior to the age of live-streaming e-commerce, the monetzation of that advantage was realized mainly through advertisements, which is also currently the major income of U.S social media sites such as Facebook. Now as shopping platforms like Taobao and JD.com transform into a semi-content platform by integrating the feature of livestream, competing for user traffic, social media sites are also turning to e-commerce to monetize their huge traffic pool. Both Douyin and Kuaishou introduced e-commerce features such as in-app shops and shopping carts in 2018, allowing users to make purchases while watching livestreams, which, unsurprisingly, gave rise to a number of livestream e-commerce teams.

When the pandemic hit in 2020, livestreaming e-commerce was among the very few that did not wither. On the contrary, the industry took off like a rocket (the other lucky dog was online education). The immobility and boredom under home quarantine fostered an emerging set of shopping habits that follow the new logic of livestreaming e-commerce: open a app, find your favorite livestreamers, watch them perform and recommend, until finally making a purchase with the livestreamers' adrenaline-pumping countdown, "5, 4, 3, 2, 1, Put up the link!"

The boom of livestream e-commerce is also accompanied by stories of overnight fortunes. Among the first few who got invited to Taobao’s livestream program was Viya, who later became one of the most successful livestream salespeople in China, making more profit in one day (Single’s Day 2019, $385 million) than Aston Martin does in a year. Other livestream legends include Austin Li, who sold $1.7 billion in 12 hours in the latest Shopping Festival, and Cherie, who once sold $47 million in one live show.

Stories like these attract more and more followers on into the industry. In the year 2020 alone, China saw 6939 more registrations of livestreaming e-commerce companies, a 360.8% year-on-year growth, and the number of e-commerce livestreamers rocketed from 2.7 million to 12.3 million, according to iResearch.

The rapid expansion of livestreaming ecommerce in China as a well-established industry is also backed by local Chinese governments - support that may be hard to find in foreign territories, particularly for TikTok who just narrowly escaped a total ban in the US with Trump being voted out of office. Take Hangzhou, where big-name livestreamers like Viya and Cherie are based, for example. The city is home to a number of livestreaming e-commerce bases, including ByteDance's Douyin Livestreaming E-commerce Base and EShow Livestreaming Base, the latter of which was awarded by the Hangzhou government multiple times for its contribution to the local e-commerce economy. In July 2021, ByteDance secured yet another land in Hangzhou, which local authorities have required to be used for "Internet and short-video related business only".

Ultimately, the boom of live streaming e-commerce in China is best understood as an outcome of layers of factors, some are particular to the history of Chinese e-commerce, others universal for any Internet companies in need for commercialization.

Compared with consumers in the U.S., Chinese consumers have shown higher adaptability to changes in lifestyle brought about by technological innovations, which is exemplified by their early adoption of not just short-video apps like Douyin or digital wallets, but also a far more developed digital economy than most countries in the world, argubly including the U.S. On top of that, the pandemic offered a perfect opportunity for this new form of e-commerce to spread among the population via fast-speed 4G connections, swiftly making its way into par of the "new normal" COVID brought about.

Chinese companies may be vulnerable in front of the Party-State, but they also receive tremendous government support if they are doing the right business at the right time. Since live streaming e-commerce began to show signs of huge success, local governments in China have been both politically and economically incentivised to support the industry by inviting Internet companies to their cities and setting up pilot zones dubbed as "Live streaming Bases".

Together, these factors facilitated the rise of livestreaming ecommerce as a fully fledged industry with a whole ecosystem surrounding it. And now, TikTok wants to export that model.

SEE ALSO: Trillion-RMB Market for E-commerce Livestreaming in China: Report by KPMG and AliResearch

Challenges ahead

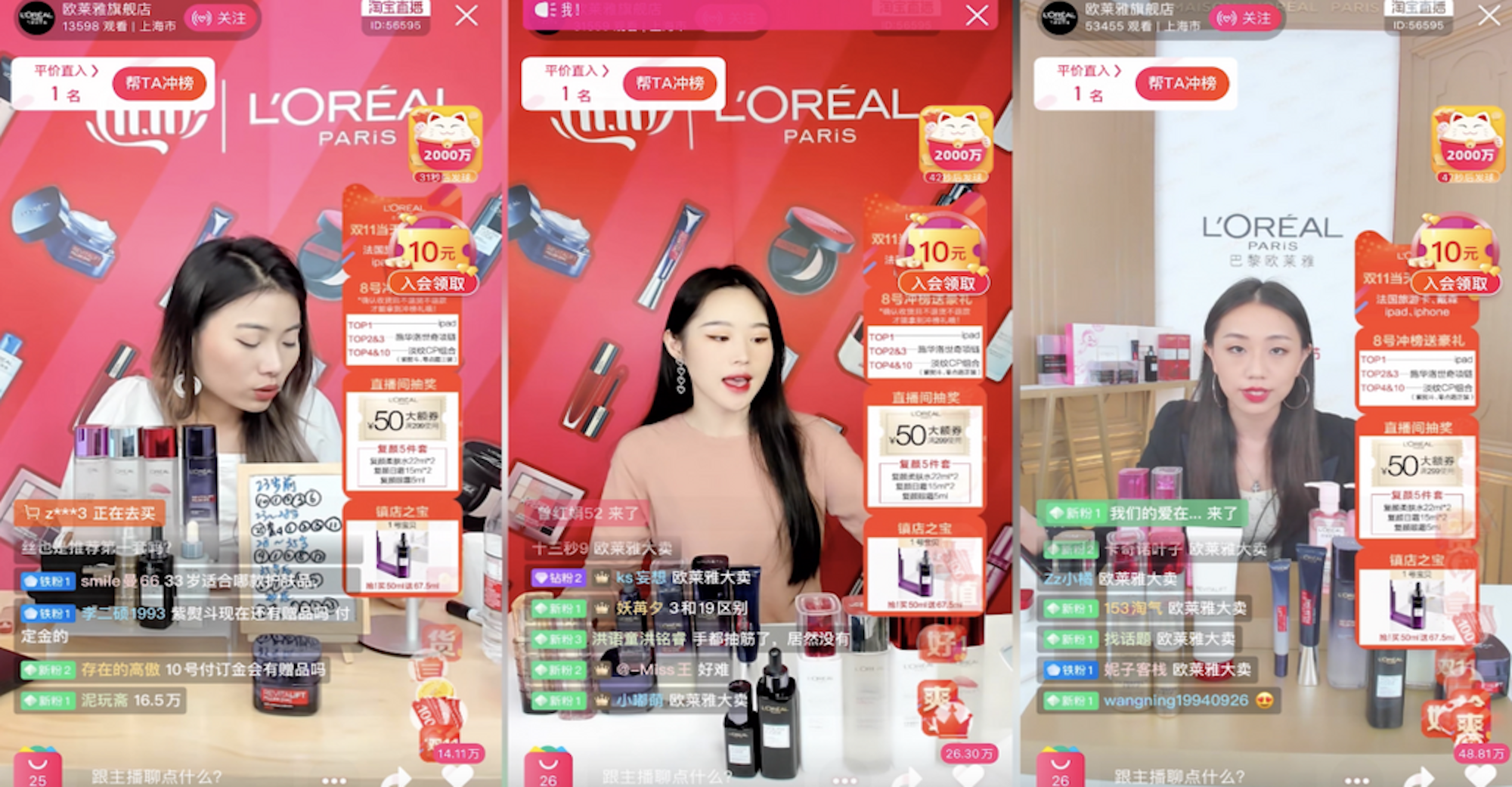

Inside the Chinese livestreaming e-commerce community, “human, product, platform” (人货场) form the typical model of a livestreaming shopping event. Respectively, they refer to the person sitting in front of the camera, which can be a social media influencer or a professional livestream salesperson, the product for sale, and the platform for the livestream to take place.

In a discussion with Global Gateway, Iris from ByteDance explained that this “human-product-platform” model remains largely the same everywhere, and it is the different customer habits and market environment that pose real challenges to first movers like TikTok.

"Before we talk about livestreaming e-commerce, you have to deal with the fact that overseas users don't even know what livestreaming is", said Iris, pointing to the development gap between the Chinese livestream ecosystem and that of other countries. In countries like the U.S, livestreams mostly remind people of game livestreams on Youtube, or tech companies' product release Live events, while content and interest-based livestream has not yet entered the mainstream, not to mention online shopping via livestream.

At present, Iris said, TikTok is hoping to develop users' familiarity with livestreaming both as a way of socialising and as a form of digital shopping. "It is much easier for people to adapt to livestream if you start from a content platform, rather than an e-commerce platform", Iris added, citing the example of Amazon, which clearly has the lower hand compared with TikTok when it comes to the ability to attract user attention.

The company is now inviting merchants to open Live shops on TikTok, and educating them on generating more traffic. According to Iris, in the case of the UK, however, TikTok shops are mostly operated by Chinese cross-border e-commerce teams, who seem to hold more confidence than their foreign counterparts, perhaps because they have witnessed the boom in the Chinese market, and no one want to miss the next bandwagon. Gu Jun, founder of a Chinese cross-border e-commerce company NewMe predicted in a recent interview that "TikTok livestream is likely to contribute 90% of our total sales in the near future".

"Now that things are just starting up, TikTok is being extremely generous with its resources", said Iris. Such resources could come in the form of more traffic distributed to newcomers' shops, or connecting merchants with social media influencers. "TikTok isn't just inviting brands. They are inviting influencers too," Iris explained.

As one of the core elements of the "human-product-platform" model, influencers connect brands and consumers, and more often than not, the success of livestream e-commerce depends on the influencer's persona and professionalism when recommending a product. Multi-channel networks (MCNs) are agencies that train and manage professional influencers for livestream e-commerce. Right now, a number of MCNs in China are turning to TikTok. Companies including Yowant and Joy Media have already begun investing in potential livestreamers in North America, according to Wang Ruohui, CEO of Orange Overseas Platform, a Hangzhou-based MCN.

Meanwhile, TikTok is also encouraging e-commerce focused MCNs on Douyin to transplant their experience in the Chinese market directly into overseas markets. While it is possible to transplant a business model in foreign lands, as ByteDance has already done with TikTok, the future bears uncertainties as some of the factors that fueled livestreaming e-commerce's success can be hard to find outside the borders of China.