-80.jpg)

Meet Jingxi, JD.com's Attempt to Fend Off Pinduoduo and Tackle China's Lower-Tier Cities

China's largest online retailer JD.com has rebranded its own group-buying app & WeChat mini-program as ‘Jingxi’ to target consumers in China’s lower-tier cities.

China's largest online retailer JD.com has rebranded its own group-buying app & WeChat mini-program as ‘Jingxi’ to target consumers in China’s lower-tier cities.

Formerly known as JD Pinggou, Jingxi was relaunched in September to combat group-buying competitors Pinduoduo and Alibaba's Juhuasuan.

Jingxi's WeChat mini-program comes armed with a special access point on WeChat and a sleuth of different functions catering to consumers in lower-tier cities.

We take a deeper look at Jingxi and how it fits into JD.com's broader strategy.

How Jingxi Fits Into JD.com's Dual-Brand Strategy

Jingxi enables JD.com and its merchants to adopt a “dual-brand” strategy and target two different customer groups.

While JD.com focuses on providing high-quality, branded goods for consumers in Tier 1-2 cities, Jingxi is a social e-commerce marketplace that targets price-sensitive customers in smaller Tier 3-6 cities and rural areas. During Singles Day, approximately 75% of Jingxi's new users came from lower-tier cities.

Group-buying promotions and WeChat are a crucial part of this strategy. Not unlike Pinduoduo's strategy, customers who share product-related information on WeChat and invite friends, family members and other contacts to place a group order are eligible for rewards and steep discounts.

This works because consumers in lower-tier cities tend to act more on social prompts from friends that they trust, and make impulse purchases when products and promotions are shared with them. But these consumers are also price-sensitive, meaning that deep discounts are necessary to facilitate these impulse purchases.

This lowers customer acquisition costs because the discounts are less than what it would take to acquire new customers through ads or influencer marketing.

Jingxi's WeChat mini-program, a down-sized version of its standalone app, plays a key role in facilitating these purchases as it enables friends to share products and promotions with one another. It is also a better fit for consumers in smaller-tier cities who may have cheaper phones with less memory and do not want to download another app.

WeChat added a Jingxi link on its interface on October 31 to kick off Singles Day promotions, and within just one hour of doing so, the Jingxi mini-program booked over one million orders. A total of nearly 60 million items were sold over the course of the day.

WeChat mini-programs will play an increasingly important role in China e-commerce. A few weeks ago, WeChat started to block external links with "commercial purposes" from other e-commerce platforms (i.e. Tmall/Taobao), out of fear that they would impair WeChat’s user experience. This means that customers can only share e-commerce items from WeChat mini-program stores, and not HTML links.

This encourages e-commerce players to engage in social commerce within WeChat's ecosystem, which is why Jingxi launched a WeChat mini-program in parallel with its mobile app.

Key Functions Within Jingxi’s Mini-Program

Livestreaming

Jingxi also places an emphasis on using livestreaming channels to raise conversion rates. Livestreaming, in which young influencers broadcast live, interactive video sessions of themselves trying on new products, is highly popular in smaller Chinese cities.

Viewers can ask the host questions in real time, and product links are embedded in each livestreaming channel, enabling viewers to "buy while watching". After the session is over, users who missed the session can also replay the videos.

1 RMB Group-Buying Deals

For new users, Jingxi also offers a 1 RMB group-buying deal for new users. For example, the first promotion below indicates that users can get ten wet wipes for just 1 RMB if they can get another friend to join in on the deal.

For Singles Day this year, Jingxi offered 100 million of these deals to draw new customers, as well as flash sales promotions and other types of discounts.

Manufacturer Direct Supply

Next up is the Manufacturer Direct Supply tab, which offers low-priced goods sourced directly from manufacturers; these promotions are typically group-buying promotions as well. Group purchases make it more worthwhile for manufacturers to ship directly to consumers, as their warehouses typically are not equipped to ship parcels one-by-one.

By matching manufacturers with end-customers that are geographically closer and pooling together orders, JD.com is lowering per-order shipping costs, which is important when targeting lower-income consumers with limited purchasing power. Jingxi is expected to connect 1,000 industrial and manufacturing hubs within three years.

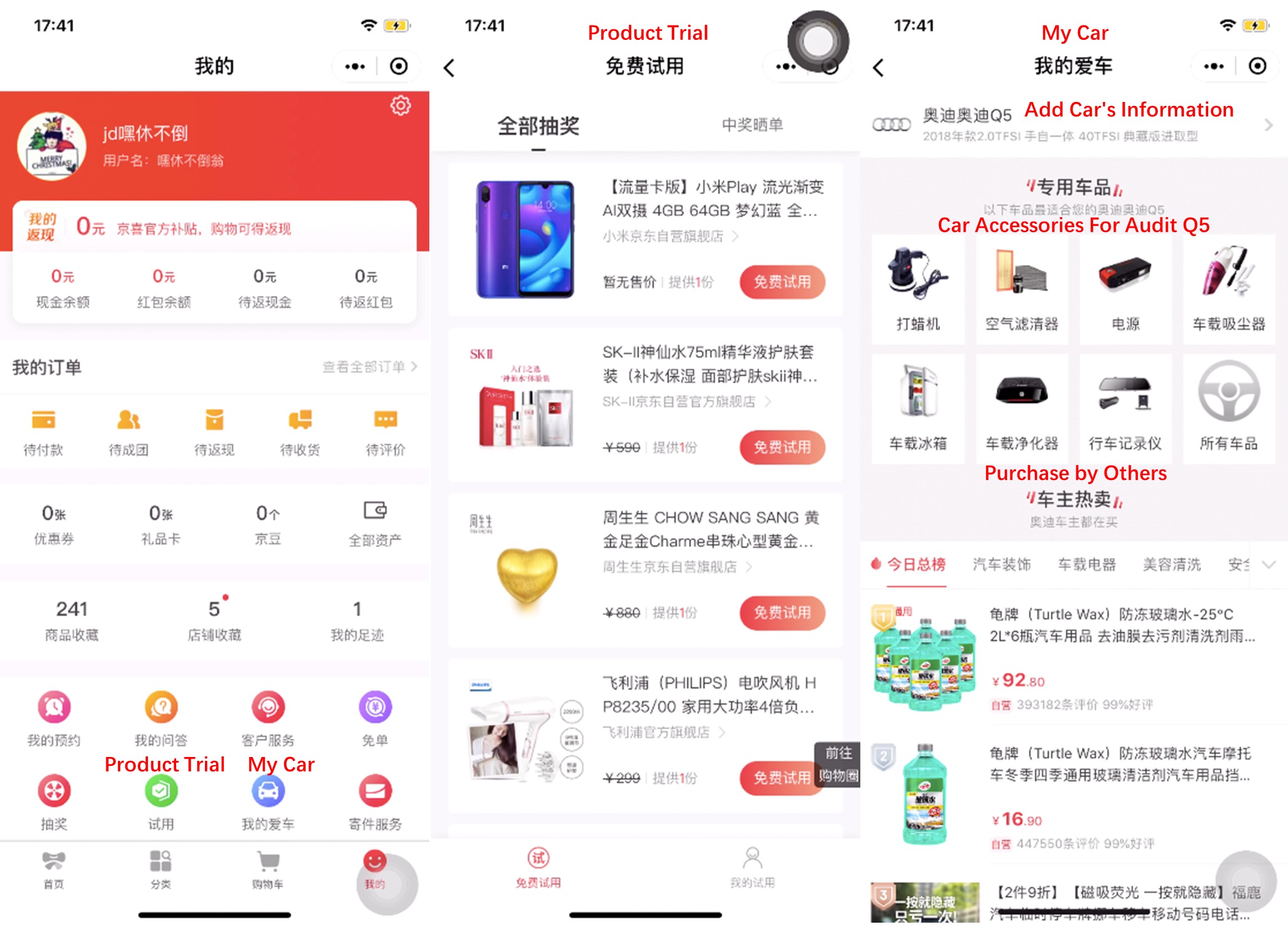

Product Trial

Jingxi also provides an interesting “Product Trial” service that is available for products ranging from jewelry to mobile phones and other electronic devices. The appointment service allows the customer to try the product at a low cost or even for free before making a final purchase.

This appeals to consumers in lower-tier cities because their disposable income is much more limited; purchasing a 2,000 RMB phone is a big deal because it can account for the bulk of a person's monthly salary.

My Car

Another unique feature is the My Car tab. This page recommends car accessories for customers who input their car's make and model. The page also shows what other people with the same car are buying, giving potential customers a sense of the market and putting potential concerns about quality at ease.

Although Jingxi is focused on serving lower-tier city consumers, such functions help show that JD.com as a whole is capable of providing a much more premium and complete shopping experience.

While these consumers may not have a need for such value-added services at that particular point in time, this may change as their disposable incomes and needs change over time. This is important because it differentiates Jingxi from its other group-buying competitors.

Key Takeaways:

- Jingxi enables JD.com to better target lower-tier city consumers, giving its merchants the chance to adopt a dual-brand strategy: JD.com for Tier 1/2 cities, and Jingxi for lower-tier cities

- Though social sharing e-commerce links from external applications have been blocked by WeChat, Jingxi mini-program has a prime access point on WeChat's main interface, giving it a chance to reach WeChat's billion-plus followers and leverage social commerce marketing tactics

- Jingxi incorporates livestreaming, 1 RMB deals, and factory-supplied goods to appeal to price-sensitive customers in lower-tier cities. Other functions such as the Product Trial function and the My Car function provide value-added services to enhance the shopping experience for the end customer.

Original article is posted on Azoya.