What You Need to Know About China’s Soaring Household Debt

Want to read in a language you're more familiar with? Please click the pink icon below for one-click AIPlease click the pink icon top right for one-click AI translation

China’s household debt to income ratio rose threefold from 30% in 2008 to 92% in 2019. Here is what it could mean for China’s economy.

The common stereotype about the Chinese that even most Chinese would agree with is that they are frugal. They love to save, fear debt and approach consumption with a caution of a crocodile tamer. Unfortunately, as most stereotypes, it doesn’t stand the test of time. While the older generation of Chinese people did indeed have a complicated relationship with banks and credit systems, the more affluent the younger generation gets, the more susceptible they are to debt spending.

By the time the 2008 financial crisis ground to a halt, a flurry of opinions emerged on why exactly things went south. One of them, belonging to Harvard professor Kenneth Rogoff, suggested that the emerging markets like China, had been saving too much, allowing the United States to borrow inexpensively. China responded by pointing to historical antecedents that spurred on the nation’s dedication to thrift.

Ironically, a decade later the previously almost debtless Chinese society seems to have abandoned its ideals and indulged in all the money that rapid modernization brought to the country. China’s household debt to income ratio rose threefold from 30% in 2008 to 92% in 2019, according to the Institute of International Finance (IIF). Here is what it could mean for China’s economy.

The debt

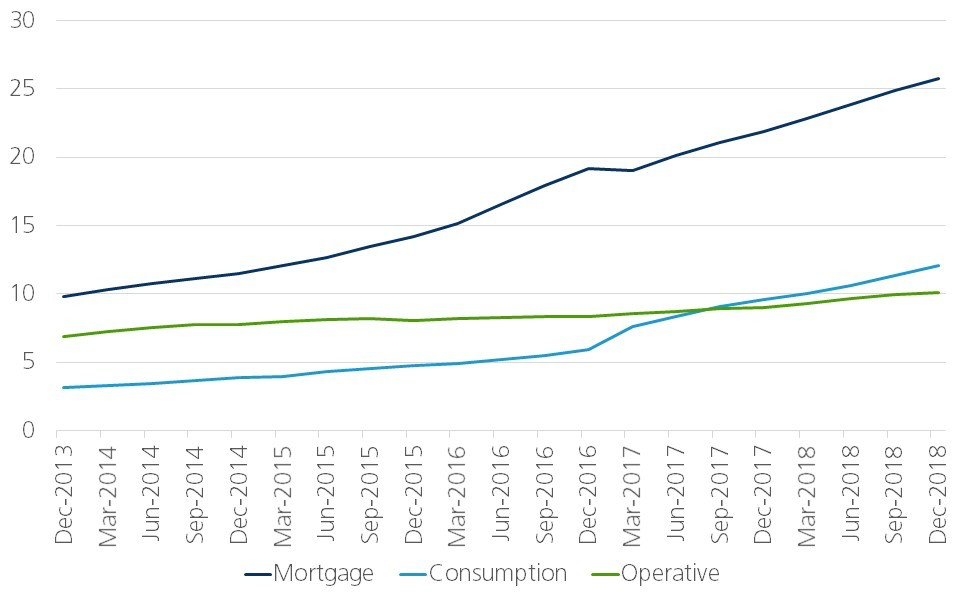

Chinese household debt was only roughly 30% of the country’s GDP in 2013, growing to 44.4% by 2016, according to the Shanghai University of Finance and Economics (SUFE). In 2019, the household debt to GDP ratio approached 52.6%, as per IIF data. The rate at which the Chinese are giving in to debt is alarming and by far exceeding that of Americans’ on the eve of the 2008 crisis, which was a result of a mortgage collapse caused by fraudulent banking practices under which thousands of subprime mortgages had been essentially repackaged as conventional ones. However, while most of the Chinese household dept also concentrates in mortgages, it is very unlikely that similar preposterousness could happen under the Chinese economic system.

Back in 2017, researchers at SUFE, signaled that the accumulation rate for short-term household loans outpaced the growth rate of medium and long-term loans in China, indicating that some households’ liquid assets such as cash, bank savings and financial assets were tightening. Put simply, they had to borrow new loans to pay off their old ones.

“The rise in housing prices results in more people wanting to buy a house. After a family buys a house, their consumption is mainly focused on dealing with that expense. The house takes up most of the family's funds, and the following bank loans would usually also be used to cover mortgage payments,” says Dr. Lu Xiaomeng of the Survey and Research Center for China Household Finance

The South China Morning Post has noted that the net savings of Chinese households – total outstanding deposits minus total outstanding loans – have been on a downward trend, signifying that people were saving less while borrowing more.

Chinese households’ debts were worth about 106% of their disposable incomes in 2017, according to Financial Times, outrunning their American counterparts by 1%. However, while American debt has been predominantly flat for years, Chinese debt is skyrocketing, exceeding the rate at which the individual income has been growing in the country. The Chinese disposable household income has been swelling by 12% per year on average, overshadowed by the 23% at which the household debt has grown annually.

“Because China’s housing prices have grown too fast in the past few years, the debt burden of households is very heavy, especially for low-income families who buy new homes. Their debt reaches figures ten times their income,” says Dr. Lu.

Where does it stem from?

The whirlwind urbanization that is characteristic of China’s breakneck economic development brought on a real estate boom that saw property prices soar to a level on par with the world’s most expensive cities like Hong Kong, New York and London. Today, buying a new home in one of China’s tier-one cities is a barely feasible task for a member of the growing local middle class, which is classified by salaries ranging from $10,700 to $40,000 a year, according to McKinsey estimates. An average family located at the top end of that range would have to struggle for at least 20 years to pay off their mortgage.

Nonetheless, the continuous rise in new property prices has reinforced the Chinese belief that real estate is the most reliable form of investment. Chinese families now tend to transfer at least half of their wealth into properties, according to the Chinese Academy of Social Sciences. With the personal debt in the country floating at around $7.5 trillion, residential mortgages comprise almost 60% of that figure. Besides, an average middle-aged person in China has to face three more financial challenges: car loans, support for the elderly, and education of children.

Everything outside property loans (and even parts of those) falls mainly into credit card borrowing that has been growing exponentially in recent years. In 2018 it accounted for 14% of total household debt and 7% of China’s GDP.

At the same time, online consumer loans provided by services like Ant Financial’s Huabei (part of the Alipay app) or JD’s Baitiao and a large number of lesser known and mostly shady small lenders have also been taking off. These loans have not yet made their way into most statistical analyses of China’s household debt structure. However, it would not be far-fetched to assume that they would take up a noticeable slice of that pie. Interestingly, Dr. Lu, who we quoted earlier, notes that these short-term low interest loan-provider apps could be instrumental in promoting domestic consumption in the near future.

Does it affect China’s economic growth?

The rising household debt burden will not go unnoticed in China’s economy. Some believe that with the worrying rate of household debt accumulation China risks repeating the fate of Japan in the 1990s or the US in 2008, which seems implausible due to critical differences in economic circumstances. Nonetheless, China’s economic growth has been decelerating for several years now, in part due to the sluggish household consumption and the soaring property debt. Although the amount of impact that those factors have on the slowdown has been debated.

However, aware of the situation in the housing market, Chinese President Xi Jinping made a speech in 2016 at the 19th party congress, stipulating that “properties are for living, not for speculation.” Unfortunately, his comments had little to no effect on the consumers.

Does it affect consumption?

Consumption is slumping. In May, the total retail sales of consumer goods in China increased by 8.5% in nominal terms and just 6.8% in real terms, both falling to a new low since 2004. China stands out among most other countries for surprising reasons. While droves of Chinese tourists in European luxury stores could fool you into thinking that they are obsessed with buying, numbers draw another picture with the share of China’s domestic consumer spending to GDP declining from 60% in 1990 to just over 30% in 2017, lower than the global average of 50-60%, according to Penn World Table.

To impede the growth of household debt hampering consumption, in 2016, Chinese authorities resorted to a contentious method that only made things worse. Banks were forced to cut down on mortgage loans, raise interest rates, and increase the requirements for down payments. However, instead of putting a check on the surging indebtedness of the general public, the move prompted more demand for higher interest loans and gave rise to a spate of fraudulent peer-to-peer (P2P) lending platforms.

“However, the fact that consumer lending is in a period of rapid growth also shows that the standards of living in China are rising rapidly,” notes Dr. Lu. Indeed, while the growth of wages might be sluggish, stability is one thing that the system doesn’t lack. China’s government goes out of its way to contain all negative economic indicators within acceptable limits.

“The percentage of the indebted population in China was 29.8% in 2013, 30.6% in 2015 and 34.9% in 2017. These figures come nowhere close to the United States with 74.5% in 2013, and 77.1% in 2016. In terms of the asset-liability ratio – the total debt of the family divided by the total assets – China is also at a relatively low level. According to the data of our research center, in 2013, the asset-liability ratio was 5.3%, last year – 6.6%," adds Dr. Lu.

Still, there are signs that Chinese consumers burdened with onerous mortgages are starting to spend money more cautiously, especially on leisure and travel, according to analysts of ING Group. People are increasingly more worried about their job security and wage growth, which is fare given China’s unemployment rate soared to 5.3% from 4.9% in just 2 months in early 2019, the highest level in two years.

Retail sales in China keep growing, but sometimes for the wrong reasons, note IGN experts. In June, for example, China's car dealers dropped prices, bolstering a 17.2% year-on-year sales growth after the disappointing 1.2% growth in the beginning of the year. The price manipulation helped improve the overall retail sales results, but it is not a dependable approach to tackling the looming problems associated with the heaping household debt.

What does the government do about it?

China’s bet on infrastructure development that propped up steady economic growth and the boom in the property market is now wearing thin. Not only do local experts predict that the growth of the Chinese housing market will taper off in the coming several years (the prices for used apartments are already starting to plummet), but the surge in debt is also pushing the government to refocus on consumer spending to address the waning growth rates.

With no personal bankruptcy laws – lenders in China can literally seize all borrower’s assets in case of a default – and with higher payoff rates than in the corporate sector, mortgages are a lucrative business for Chinese banks, yet household debt accounts for only 18% of their assets in the country, lower than in most other Asia-Pacific economies. Even so, the crippling effect the growing household debt burden could have on consumption and the economy is concerning.

The government has taken several measures to come to grips with the emerging problem. The tax threshold has been raised with the basic deduction standard for income raised to 5,000 yuan a month from 3,500 yuan. Furthermore, the progressive tax rate structure was optimized, increasing the lower band for the 35% tax bracket from 100,000 yuan to 500,000 yuan. Beijing’s efforts mainly concentrate on increased tax cuts, easier liquidity for banks, and to lesser extent on subsidies for purchases of fridges, cars and other consumer goods, especially the ones affected by the ongoing trade war with the United States. The results of the government’s efforts are still to be seen.