Featured Story

Alibaba Launches Robotics and Embodied AI

Alibaba Group has set up a dedicated Robotics and Embodied AI team, signaling its entry into the fast-growing race among global tech giants to bring artificial intelligence into the physical world.

News

Xiaomi Responds to Incident of Car Reportedly Driving Off on Its Own

AI

Afari Technology Unveils AI Plan and New Brand

Industry

ByteDance’s Doubao Translation Model Supports 28 Languages, Performance Comparable to GPT-4o

ByteDance debuts Doubao translation model: two-way across 28 languages, performance comparable to GPT-4o, with fluent output and 4K context.

WAIC2025

Zhipu AI Launches GLM‑4.5, an Open-Source 355B AI Model Aimed at AI Agents

Chinese startup Zhipu AI (now rebranded as Z.ai) has open-sourced its new flagship model GLM‑4.5, a 355-billion-parameter foundation AI model. The July 28 ann...

WAIC2025

China Proposes “World AI Cooperation Organization” at WAIC 2025

Shanghai, July 28, 2025 – At the 2025 World Artificial Intelligence Conference (WAIC) in Shanghai, the Chinese government announced an initiative to establish a...

Latest News

Dealism Raises $15 Million Angel Round to Build “Vibe Selling” AI Agents for Global Sales Teams

Dealism raises $15M (angel) led by GL Ventures; Sequoia China & Linear back its “vibe-selling” AI agents that read intent and adapt to each seller.

Dexmal Secures ~¥1B (~$140M) Across Two Rounds Led by Alibaba and NIO Capital

Dexmal raises “hundreds of millions of RMB” in A+ funding led by Alibaba; A + A+ total near ¥1B (~$140M) to accelerate embodied-AI robots.

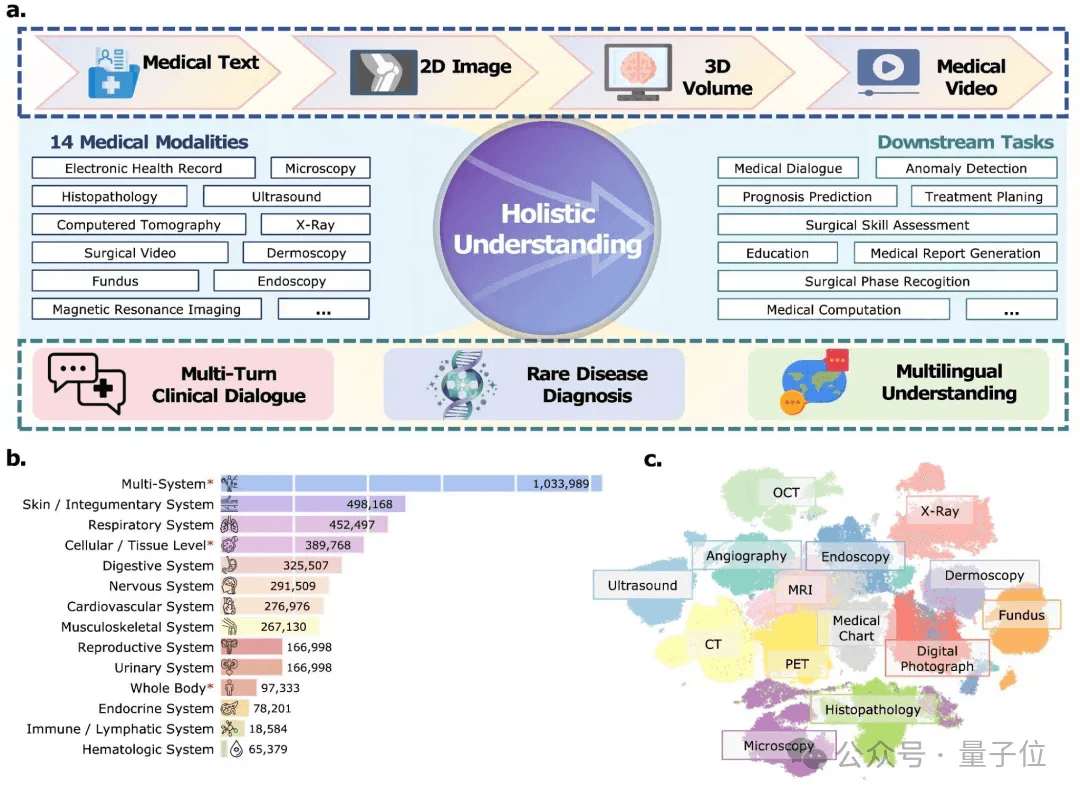

One Model for All Medical Data: Hulu-Med Explores a New Open-Source Paradigm for Medical Foundation Models | Zhejiang University × SJTU × UIUC

Hulu-Med, a new open-source medical foundation model from Zhejiang University, SJTU, and UIUC, unifies text, 2D/3D imaging, and video understanding in a single architecture and outperforms leading closed systems on 27 medical benchmarks.

Baidu's Robin Li: Internalizing AI to Turn Intelligence Into Productivity

Baidu's Robin Li says internalizing AI as a native capability will turn intelligence from a cost into productivity, as Baidu unveils new chips, ERNIE 5.0, and its self-evolving super agent at Baidu World 2025.

China Approves First Foreign Auto AI Assistants: Mercedes in Beijing; Tesla, Volvo in Shanghai

China approves the first foreign auto AI assistants—Mercedes in Beijing; Tesla and Volvo in Shanghai—paving the way for wider rollouts in 2026.

Unitree Unveils Its First Wheeled Humanoid Robot G1-D

Unitree unveils G1-D: a wheeled humanoid + “data-in, model-out” toolkit for fast capture→training→on-device inference.

Alibaba Launches “Qwen” Personal AI Assistant Project to Challenge ChatGPT

Alibaba is building “Qianwen”, a Qwen-based personal AI assistant backed by a $52B infra plan, to compete in the ChatGPT-style agentic AI era.

Duan Yongping Donates Another $30 Million to Support Education — Total Contributions Near $270 Million

On November 11, renowned entrepreneur Duan Yongping signed an agreement with the Beijing Normal University Education Foundation, donating $30 million to establi...

Featured News

Stay Updated

Get the latest China tech news delivered to your inbox