Featured Story

Zhipu AI Launches GLM‑4.5, an Open-Source 355B AI Model Aimed at AI Agents

Chinese startup Zhipu AI (now rebranded as Z.ai) has open-sourced its new flagship model GLM‑4.5, a 355-billion-parameter foundation AI model. The July 28 ann...

WAIC2025

China Proposes “World AI Cooperation Organization” at WAIC 2025

WAIC2025

AI ‘Godfather’ Geoffrey Hinton Urges Global AI Cooperation at WAIC 2025 in Shanghai

Auto

NIO's First Self-developed Chip Is Aimed at Intelligent Cabin, with Ex-Huawei Hisilicon Expert in Charge

NIO's first self-developed chip will be manufactured by Samsung, with the research and development team led by a former Huawei HiSilicon executive.

Industry

Chinese Auto-Driving Company WeRide Raises $310M in Series B Financing Deal Led by Yutong Group

China’s leading L4 autonomous driving mobility company WeRide announced Thursday it completed the Series B2 and B3 financing, marking that WeRide has raised a total of $310 million in a Series B funding.

Industry

NIO Quietly Lays Off Employees, Involving Multiple Departments Including UR Fellow

Last week, NIO made various degrees of layoffs and adjustments to departments such as UR Fellow, PT Energy Department, NIO House operations, after-sales stores, and terminal sales teams.

Latest News

Chinese Dishwasher Aims to Bridge Cultures Through Cuisine

To launch its next-generation appliance, FOTILE hosted the “Flavors from the East” event in New York on September 9, 2025.

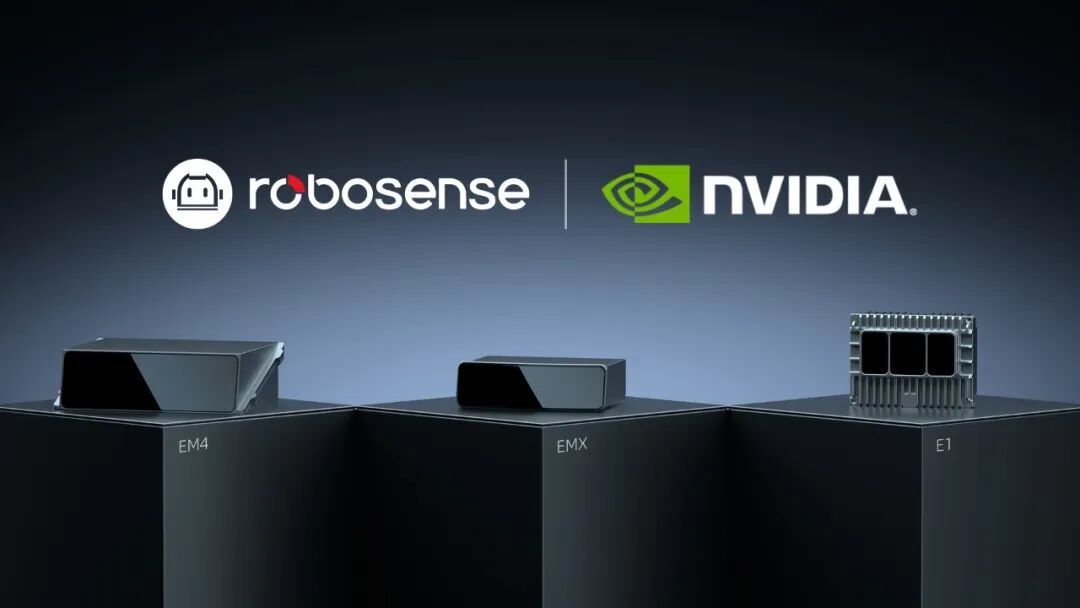

RoboSense Partners with NVIDIA to Accelerate Autonomous Driving

RoboSense (HKEX: 2498.HK), a leading LiDAR solutions provider, announced two major milestones this week, advancing its commercialization push and strengthening ...

China's First Offshore Carbon Storage Project Achieves Over 100 Million Cubic Meters of Carbon Sequestration

On September 10, it was reported that China National Offshore Oil Corporation (CNOOC) has successfully developed China's first offshore carbon dioxide storage d...

Chinese Short Dramas Surge Globally with Over 470 Million Downloads

Chinese short dramas have taken the world by storm, with over 470 million global downloads and nearly $700 million in Q1 2025 revenue, showcasing China’s innovative digital content ecosystem.

Inspired by Oysters! China’s “Bone 02” Solves Comminuted Fractures — Bonds in 3 Minutes, Avoids Secondary Surgery

On September 9th, 2025, Sir Run Run Shaw Hospital of Zhejiang University, together with several leading domestic institutions, completed the world’s first clinical study on adhesive treatment for comminuted fractures.

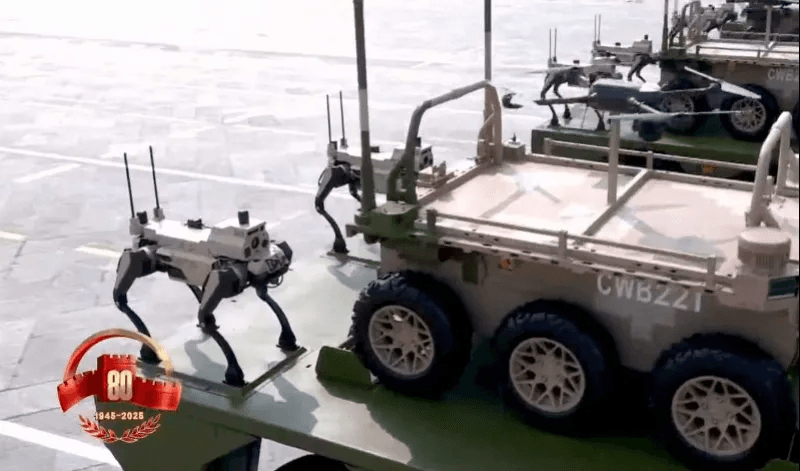

China Unveils Type 100 Tank: A Fourth-Generation Leap in Armored Warfare

From the traditional “armor-versus-shell” confrontation of shield and spear, armored warfare is now evolving into an integrated approach of “information and firepower as one.”

China’s 80th Victory Day Parade Showcases “Machine Wolf” and Advanced Arsenal

China’s 80th Victory Day parade on September 3, 2025, unveiled the cutting-edge “Machine Wolf” unmanned combat system alongside advanced weaponry, showcasing the nation’s military innovation and commitment to peace.

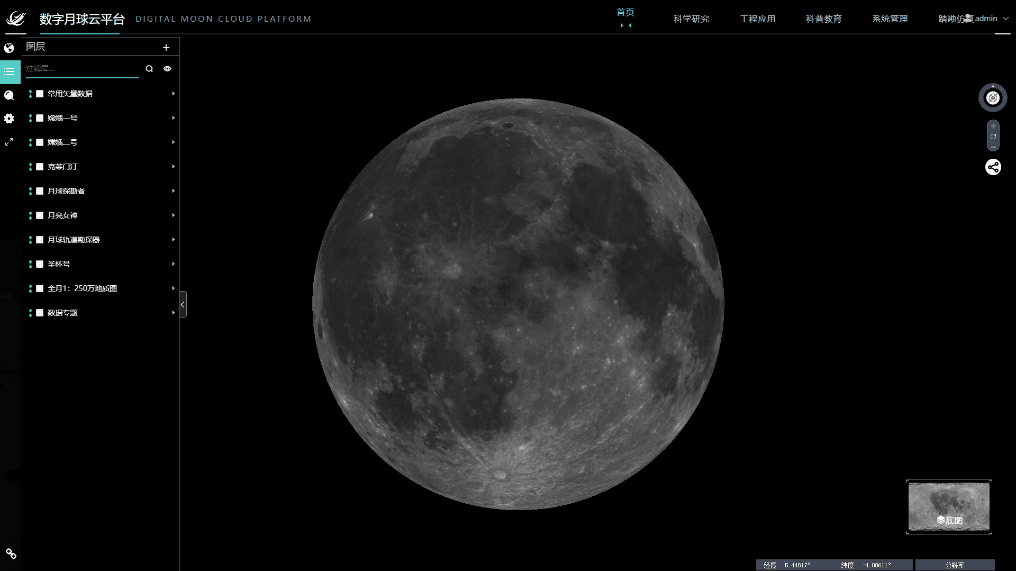

"Lunar Science Multimodal Professional Model V2.0" Released

On August 29, the Institute of Geochemistry, Chinese Academy of Sciences, officially unveiled the "Lunar Science Multimodal Professional Model V2.0" at the 2025...

Featured News

Stay Updated

Get the latest China tech news delivered to your inbox